Global economic weakness due to monetary policy not trade wars

The preferred narrative of central bankers and mainstream economists is that current global economic weakness primarily reflects US-driven trade policy conflict, which has depressed business confidence and derailed expansion plans. This narrative is false.

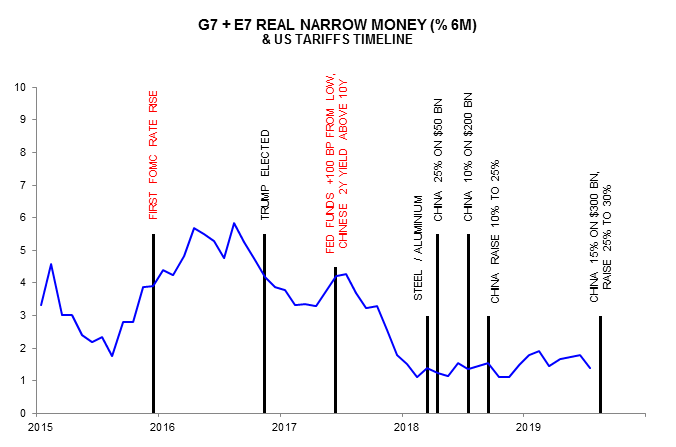

The loss of economic momentum started in H1 2018 and followed a collapse in global six-month real narrow money expansion during H2 2017. This collapse was caused by Chinese and US monetary policy tightening: the Fed had raised rates by 100 bp by June 2017, while the PBoC’s liquidity squeeze on shadow banking had inverted the Chinese government yield curve (i.e. 10-year versus 2-year).

The Trump administration began to impose tariffs only after the monetary shock, with the increase in coverage from $50 billion to $250 billion of Chinese imports proposed in H2 2018, by which time the global economy was already slowing sharply – see chart.

The trade conflict may have contributed to monetary weakness more recently, by suppressing spending plans and associated money demand. A more likely explanation, however, for money growth remaining low is the lagged impact of the further – and excessive – rise in US rates during H2 2017 and 2018.

Other central banks followed the Fed’s mistake of raising rates into monetary weakness, with the UK MPC an egregious offender.

The trade conflict provides a convenient excuse for such actors, enabling them to deflect blame for their policy errors. Mainstream economists are in collusion because of their own failure to forecast economic weakness.

Monetary policies are now easing but moves to date may be insufficient to offset previous excessive tightening and negative trade policy effects. This is suggested by weak July money numbers: as previously discussed, global real narrow money growth appears to have fallen sharply – additional July data this week will provide clarification.

Reader Comments (1)

Hello.

I'm curious as to whether you share my view that central banks just follow the market rates up and down?

That's my view, and this year for example, the whole yield curve has fallen, and eventually bill yields fell too, meaning the Fed had to follow along. Ditto on the way up.

But the vast majority of lending/borrowing is not tied to central bank overnight rate anyway.

So, I blame the foolish humans who buy and sell bonds and bills, not the foolish humans who meet at central banks.

Regards.