Euroland money trends suggesting relative resilience

Euroland money growth was little changed in April and continues to give a hopeful message for economic prospects. Global weakness and a reversal of UK pre-Brexit stockbuilding, however, may delay a recovery in momentum until late 2019 / 2020.

Six-month growth rates of real narrow and broad money, as measured by non-financial M1 / M3, edged lower in April but remain well above lows reached in July and March 2018 respectively. The rise from those lows has already been reflected in a small revival in two-quarter GDP momentum – see first chart.

Euroland real narrow money growth, unusually for recent years, is above levels in both the US and China.

In addition, the Kitchin inventory cycle downswing may be further advanced in Euroland relative to other regions. In Germany, in particular, inventories subtracted 0.3 percentage points (pp) from the quarterly change in GDP in the first quarter, following a 0.5 pp drag in the fourth quarter. US inventories, by contrast, contributed positively to GDP growth in the latest three quarters, by a cumulative 0.8 pp.

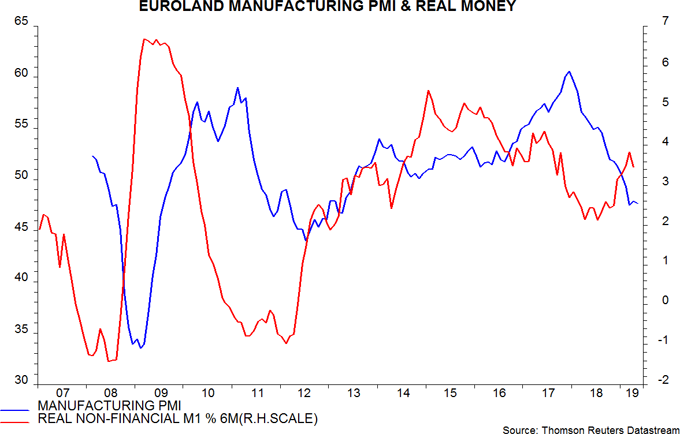

The recovery in real money growth suggests that the manufacturing PMI is at or close to a bottom – second chart.

The main reason for caution is the likelihood of further US / Chinese economic weakness depressing exports and, by extension, business investment. Exports, moreover, have been supported by UK Brexit-related stockpiling, which is now reversing.

Current conditions may be the mirror-image of those in 2016-17. Real narrow money growth moderated over this period but US / Chinese economic strength boosted exports / investment and delayed a peak in the manufacturing PMI until December 2017. Global weakness may now postpone a Euroland economic recovery until 2020.

Reader Comments (1)

M1/M3 ratio?

Surely this just shows the EU lagging the cycle like all post war recessions.

Real M1 will now follow the US and China towards zero or below.

The surprising thing about this cycle is how weak the EU has been in advance, whilst the US was still growing strongly. Usually the US pops first.

China weighing on DE external balance probably the cause?

I doubt there will be a recovery even in the medium tern, with monetary policy maxed out fiscal stress will blow the EMU apart.