Entries from June 1, 2017 - June 30, 2017

UK inflation: core surge continues

The divergence of UK and US monetary policies looks increasingly odd. Inflation and unit labour cost growth are higher in the UK than the US, while GDP growth and job market conditions are similar – unemployment and underemployment rates in both countries are close to prior-cycle lows. Brexit is negative for UK growth prospects but represents a supply as well as demand shock. Mismanagement of Brexit and a loss of fiscal discipline threaten to exacerbate sterling weakness, entrenching high inflation.

The case for a rise in UK rates is strengthened by today’s news that consumer price inflation rose further to 2.9% in May (2.87% before rounding), significantly above the 2.65% projection for the second quarter in the May Inflation Report. The forecast here remains for inflation to move above 3% during the second half.

The May increase was driven by "core" inflation. The preferred core measure here is the CPI excluding energy, food, alcohol, tobacco and education adjusted for the estimated impact of VAT changes. Core inflation rose to 2.5% (2.53%) in May, the highest since 2012 – see first chart.

Core prices increased at a seasonally adjusted annualised rate of 3.0% in the three months to May from the previous three months – second chart*. If prices were to rise at this rate over the next three months (i.e. June-August), core inflation would increase further to 2.8%, partly reflecting weak core momentum in summer 2016.

Last month's update argued that an acceleration of food prices would contribute to CPI inflation increasing further. Food inflation rose from 1.8% in April to 2.5% in May, with recent large increases in home-produced and imported food material costs suggesting a pick-up to perhaps 5-6% later in 2017 – third chart.

As previously argued, inflation is rising in lagged response to a significant increase in monetary expansion between 2011 and late 2016. The fall in the exchange rate has been part of the “transmission mechanism” from loose money to faster price rises, rather than being a primary driver. The historical evidence is that money growth peaks lead core inflation peaks by between two and three years. Assuming that annual broad money growth peaked in autumn 2016**, this suggests that core inflation will remain under upward pressure through late 2018, at least.

*Seasonally adjusted using X12 procedure.

**Annual growth of non-financial M4 reached 6.8% in September 2016, falling to 5.4% by April 2017.

US money trends still strengthening

US monetary news remains upbeat, suggesting that stronger economic growth in late 2017 / early 2018 will force the Fed to tighten by more than currently discounted.

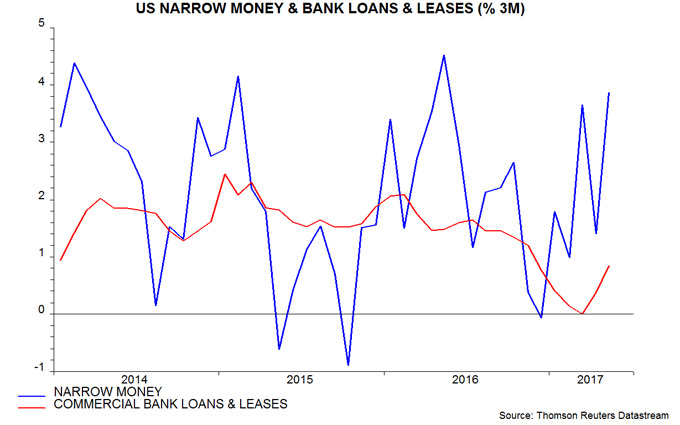

The narrow money measure tracked here fell in the week to 29 May but is on course to rise by about 1.75% in May from April (month average basis). This would push three-month growth up to about 4% (not annualised), the fastest since May 2016 and up from zero in December – see first chart.

Bank lending, meanwhile, is reviving. The stock of commercial bank loans and leases rose by 0.4% in May after a 0.5% April gain, pushing three-month growth to its fastest since November.

The view here is that the earlier narrow money / lending slowdown reflected a rise in bank funding costs and an associated tightening of credit conditions caused by changes to money market fund regulations in 2016. These changes resulted in money funds reducing their lending to banks while buying Treasury and agency securities, pushing up funding spreads. Money funds reduced their holdings of bank deposits and commercial paper (CP) by $565 billion during the final three quarters of 2016, according to the Fed’s Z.1 financial accounts.

The portfolio shift appears to have been completed by end-2016, with the latest Z.1 accounts, released last week, showing a $34 billion recovery in money funds’ holdings of deposits and CP in the first quarter of 2017. An associated normalisation of funding spreads has, on the interpretation here, been a key driver of the pick-up in narrow money and credit.

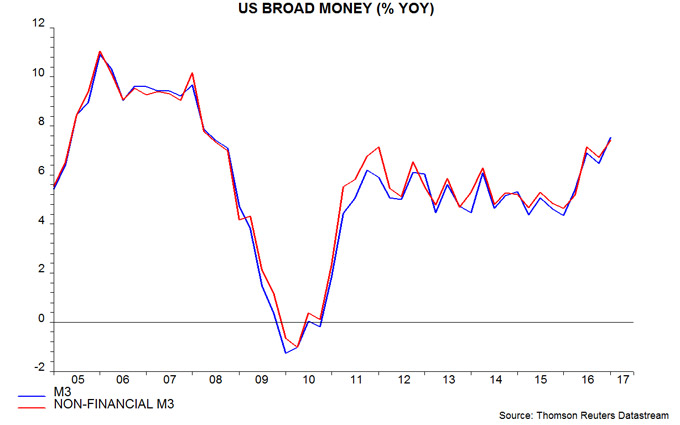

Broad money, meanwhile, continues to expand robustly. The Fed stopped publishing M3 data in 2006 but a quarterly series can be derived from the Z.1 accounts. Annual growth of this measure rose to 7.5% at end-March, the fastest since 2008 – second chart.

There is some confusion about broad money trends at present. The ShadowStats website produces a monthly M3 estimate and claims that annual growth was only 3.3% in April. There is, however, a problem with the ShadowStats methodology – M3 is estimated by adding large time deposits at commercial banks (among other items) to the official M2 series but these deposits include holdings of money market funds, which should be excluded to prevent double-counting (i.e. M3 should include the liabilities but not assets of money funds). As noted above, money funds have slashed their deposit holdings over the past year, resulting in the ShadowStats measure understating M3 growth.

Is Eurozone economic news peaking?

Economic news has surprised positively in the Eurozone but negatively in the US in recent months, probably contributing to Eurozone equity market outperformance. Monetary trends suggest that this gap will close during the second half of 2017, with convergence driven initially by a cooling of Eurozone news.

Citigroup’s G10 economic surprise index reached a six-year high in January but has fallen sharply since March, to around zero – see first chart. With positive and negative news balancing out, a reasonable interpretation is that the global economy is no longer accelerating, consistent with the forecast here that momentum would peak in the spring and decline over the summer. The latter development should be signalled by the surprise index turning negative.

The move lower has been driven by downside surprises in the US and UK, with Eurozone news remaining upbeat and Japanese news strengthening recently. This pattern accords with earlier monetary trends: six-month growth of real narrow money in the US and UK fell sharply in late 2016, moving below solid levels in Euroland and Japan – second chart.

As previously discussed, however, US real money growth has rebounded strongly since early 2017, and the expectation here is that it will move above the Eurozone level in June. The US economy, therefore, should reaccelerate by the fourth quarter, in which case the US surprise index is likely to return to positive territory, converging with or overtaking the Eurozone index.

Consensus economic expectations for Euroland may have become overinflated, partly reflecting the recent strength of purchasing managers’ surveys – the composite PMI output index reached a six-year high in April / May. The suggestion, however, that economic growth has stepped higher is not supported by monetary trends, with six-month real narrow money expansion in the middle of its range over the past three years. The expectation here is that GDP will continue to expand at its recent pace of 1.75-2.0% annualised.

PMI trends correlate loosely with real money growth nine months earlier – third chart. Recent PMI results have been stronger than expected based on this relationship but may incorporate a temporary sentiment boost from the French election result. The appreciation of the euro is a potential drag – the effective exchange rate has risen by 3% since April. A reversal of PMI gains may contribute to the Eurozone surprise index following the US index into negative territory over the summer.

US monetary pick-up suggesting faster Fed tightening

Recent US narrow money acceleration continued in the latest week. The last real money growth data point in the chart below is a June projection assuming that the level of narrow money stabilises at its latest reading (week ending 22 May) and consumer prices rise by 0.2% in both May and June.

The continued pick-up is consistent with the story of a monetary boost from the normalisation of bank funding markets following the disruptive effect last year of money fund regulatory reform.

This US monetary boost may explain the buoyancy of US / global equity markets despite evidence that global economic momentum is rolling over, e.g. the manufacturing PMI fell to a six-month low in May.

The monetary pick-up, however, suggests that US growth will buck the global trend and rebound strongly by late 2017, in which case the Fed may need to step up the pace of tightening to prevent labour market overheating. The market may be complacent in discounting only a 50% probability of more than one quarter-point rate hike, and just 10% of more than two, over the remainder of 2017 (CME FedWatch tool).