Entries from January 1, 2012 - January 31, 2012

UK fiscal deficit on track, Treasury should book QE net income

UK public sector net borrowing excluding the temporary effects of financial interventions (PSNB ex) remains on course to hit or undershoot the OBR’s November 2011 forecast of £127 billion (revised up from £122 billion in March) despite economic weakness.

December borrowing of £13.7 billion was down from £15.9 billion a year before and £1.2 billion below the consensus forecast, according to Reuters. There was, however, an upward revision of £1.3 billion to prior months in 2011-12.

PSNB ex was £124.8 billion in calendar 2011, implying that borrowing in the first quarter of 2012 must exceed the level a year earlier for the OBR forecast for 2011-12 not to be undershot.

PSNB ex was 8.3% of GDP in calendar 2011 versus an OBR forecast of 8.4% for 2011-12.

The view here remains that the fiscal position is better than implied by the PSNB ex measure since financial interventions are now generating a sizeable surplus, not all of which should be discounted – see previous post for more discussion. Total borrowing (i.e. net of this surplus) was £91.3 billion (6.0% of GDP) in calendar 2011, down from £122.5 billion in 2010 – an impressive 25% reduction.

Of the £33.5 billion positive impact of financial interventions last year, £19.6 billion represented the operating surplus of the public sector banks with a further £8.1 billion due to Bank of England net interest income from the Asset Purchase Facility (APF) and fees from the Special Liquidity Scheme (probably small). (The remaining £5.8 billion includes the surplus of the banks’ subsidiaries.) There is a strong case for the Treasury booking the Bank's net income from QE rather than allowing it to accumulate off-balance-sheet in the APF. This could be achieved by the APF paying the Treasury an annual dividend. Such a treatment would be equivalent to that adopted in the US, where the profit of the Federal Reserve, including its net income from QE, is distributed to the Treasury. The Fed has estimated that the distribution relating to 2011 will be $76.9 billion, up from $31.7 billion in 2008, with the increase mainly reflecting the expansion of its balance sheet due to asset purchases.

"Monetarism" suggests inflation revival in late 2012 / 2013

A post last April suggested that G7 consumer price inflation would peak in autumn 2011 and decline into 2012. Relief, however, was expected to be modest and temporary.

The forecast is on track, with annual inflation topping at 3.2% in September and down to an estimated 2.5% in December. A slowdown in commodity prices during 2011 points to a further decline in early 2012 – see first chart.

The forecast was based on the monetarist rule that money supply changes lead inflation by about two years. A smoothed measure of G7 narrow money growth rose between September 2007 and October 2009, correctly predicting the 2010-11 inflation upswing. It partially retraced this increase in 2010, reaching a trough in August, suggesting that inflation would decline from autumn 2011 to a low in summer 2012 – second chart.

The inflation slowdown has been factored into current market pricing. The smoothed money measure, however, has continued to trend higher from its August 2010 trough. The global monetary pick-up during 2011, discussed in numerous previous posts, should sustain this increase, with a possibility that the measure will surpass its 2009 high.

The monetarist rule, in other words, suggests that inflation will revive later in 2012 and into 2013, with a significant risk that it will exceed its 2011 peak next year. Recent firmer commodity prices could be early evidence of this scenario. Bond markets usually anticipate inflation, implying higher yields by the summer, although central bank manipulation may damp the move.

Investor risk appetite reviving but still subdued

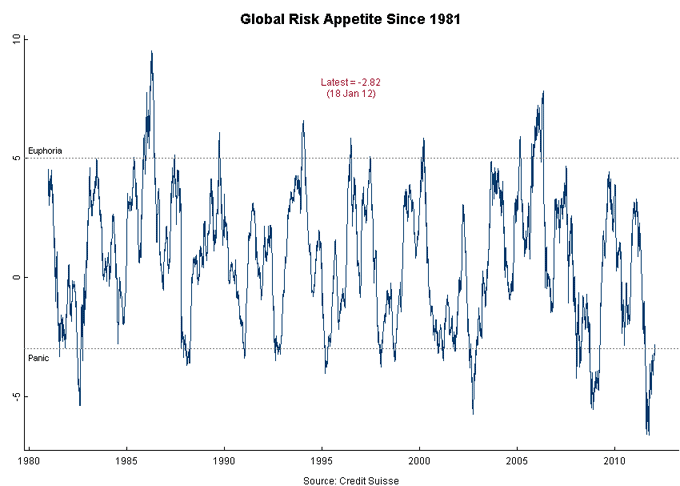

World equities are up by 14% in US dollar terms from their early October low but Credit Suisse’s global risk appetite measure has only just exited “panic” territory – see first chart. On this measure, at least, “risky” assets are not yet overbought.

The Credit Suisse measure remains depressed partly because of the continuing strength of “safe” assets like Treasuries and gilts. A shift of funds out of safe assets into equities etc often marks the final stage of risk rallies. Such a shift has yet to occur.

Treasuries and gilts, admittedly, are being artificially boosted by central bank manipulation in the form of “Operation Twist”, UK QE2 and an extension of existing commitments to maintain rock-bottom official rates.

The combination of unappealing safe government bond yields, plentiful liquidity and a revival in global economic momentum in early 2012 may allow equities to continue to grind higher despite likely further Eurozone woes and other global risks. Even in Euroland, “Maestro” Draghi’s backdoor QE / bank bail-out operation has reduced the potential for negative developments to wreak havoc in markets.

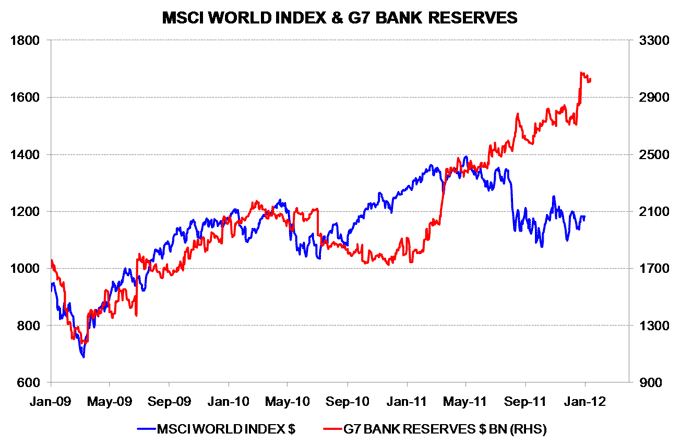

A wide gap has opened up between world equities and G7 bank reserves – second chart. There are many other drivers but the chart conveys an impression of the liquidity “cushion” under markets and the scope for further gains should investors move into full “risk-on” mode.

UK labour market statistics: could be worse

Feared UK job losses did not occur in late 2011, confirming a message of resilience from online job openings – see Monday’s post.

The three-month average of employees in employment stood at 24.79 million in November, the same as two months earlier. This follows a sharp decline last summer – see first chart. Total employment has risen slightly recently, reflecting increased self-employment.

Employee numbers follow the official vacancies series with a lag. The latter continues to flatline, suggesting stable job prospects for early 2012 – first chart.

The bad news in today’s report was a further rise in the labour force survey (LFS) measure of unemployment to 2.68 million in the three months to November. The increase since the summer, however, reflects a combination of growth in the working population and a decline in inactivity rather than reduced employment. The LFS measure, moreover, follows the claimant count, which has stabilised over the last three months – second chart.

UK inflation: stubborn "core" pressures at odds with consensus optimism

UK consumer price inflation fell to an annual 4.2% in December as energy and food prices slowed and the effects of last year’s VAT hike started to drop out of the comparison. A sharp decline in late 2011 had been widely predicted so today's news does not represent a favourable surprise. (A 4.2% end-year headline rate was forecast here in the summer.)

The December CPI print was above 2% for the sixth consecutive year.

The Bank of England’s claim that CPI inflation will fall dramatically during 2012, finishing the year below target, has, like its earlier optimistic forecasts, been accepted by the consensus – the average projection for the first quarter of 2013 is 1.9%, according to Consensus Economics. Such a plunge, however, requires a significant decline in “core” price momentum and / or further weakness in global commodity prices – both doubtful.

The first chart below shows one measure of core prices – the CPI excluding unprocessed food and energy incorporating an attempt to strip out recent VAT effects and adjusted for seasonal factors. The 12-month increase in this measure rose to 2.6% in December, the highest since January 2010. Six-month momentum of smoothed prices was slightly lower at 2.5%, having been stable during the second half of 2011, showing no response to economic weakness.

The six-month momentum measure has remained at or above 2% since January 2008. It failed to rachet lower in the wake of the “great recession” so is unlikely to drop suddenly now.

If core inflation remains resilient, forecasts of a sub-2% headline rate will depend on a big drag from food and energy prices. Food should have a favourable impact but energy and other industrial commodities tend to correlate with emerging-world economic activity, which is now reviving. The second chart shows the six-month change in the Journal of Commerce industrial commodity price index together with a leading indicator for the “E7” emerging economies. The leading indicator has recovered to a level historically consistent with rising raw material costs.

The third chart shows an inflation forecast based on stability in core price momentum and energy prices coupled with a fall in unprocessed food price inflation to 1% by mid-2012. It also incorporates a 0.2 percentage point upward impact from university tuition fees from October. Headline CPI inflation is projected to finish 2012 at 2.6% after reaching an interim low of 2.4% in August.

Chinese economy solid in late 2011

Chinese industrial output numbers for December confirm that the economy regained momentum in late 2011 as the authorities eased restrictions on credit and money expansion.

Six-month output growth was an estimated 6.1% (not annualised) in December, unchanged from November and up from a low of 3.7% in August. (These numbers are based on an attempt to extract a monthly volume index from published value / price data and 12-month volume growth.)

A further pick-up in real money expansion in December, discussed in a post last week, will underpin the economy in early 2012. A leading indicator derived from the OECD’s Chinese leading index suggests steady trend-like growth – see chart.

The main risk to the “soft landing” scenario is that recent monetary loosening will lead to a revival in inflationary pressures later in 2012, forcing the authorities to reapply the brakes.