Eurozone money trends arguing for earlier ECB exit

Eurozone narrow and broad money growth remains strong, suggesting a stable, solid economic outlook and rising pressure on the ECB to accelerate its “exit strategy”.

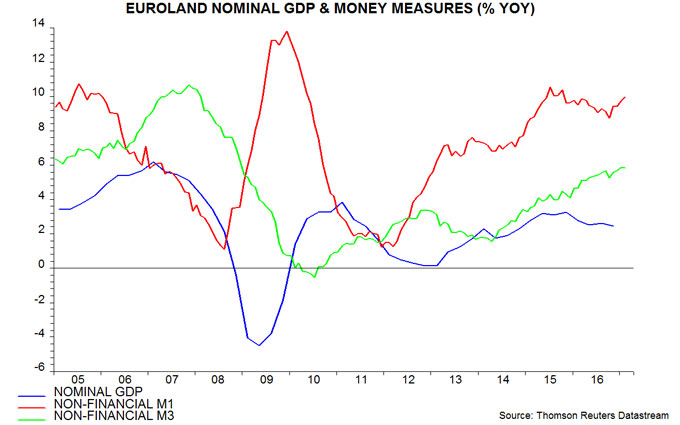

The narrow aggregate non-financial M1 – comprising currency in circulation and overnight deposits of households and non-financial corporations (NFCs) – has the strongest correlation with future GDP growth, according to ECB research. Annual growth of this measure was 10.0% in February, the fastest since 2015. The recent pick-up suggests that nominal GDP expansion will rise through 2017 – see first chart.

The broader non-financial M3 aggregate has also accelerated, with annual growth of 5.8% in January / February the fastest since 2009 – first chart.

The headline M1 and M3 measures include money holdings of financial corporations but these are volatile and contain little information about near-term spending prospects. Analysts focusing on the headline measures are at risk of underestimating future economic growth, as financial sector money has been falling – M1 grew by an annual 8.4% in February (versus 10.0% for non-financial M1) and M3 by 4.7% (versus 5.8% for non-financial M3) – second chart.

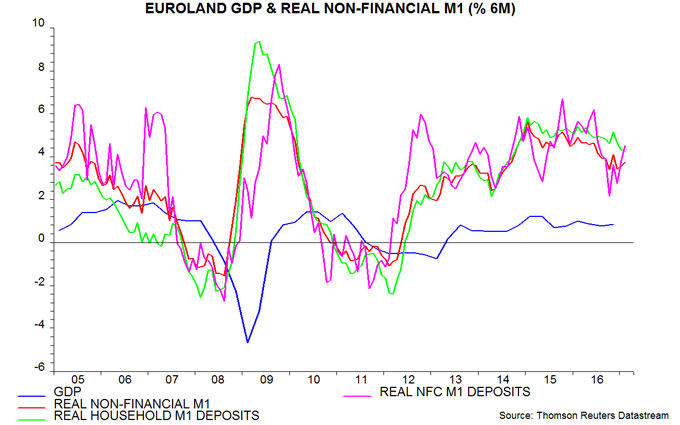

The third chart shows the two-quarter change in GDP and six-month changes in real (i.e. consumer price-deflated) non-financial M1 and its household / NFC deposit components. Real non-financial M1 growth has moderated since mid-2016 but remains solid by historical standards. The recent slowdown has been entirely due to a pick-up in consumer price inflation – nominal money growth has remained buoyant. Both household and NFC real deposits are rising strongly, suggesting solid prospects for consumer spending and business investment.

Some monetary economists attribute favourable monetary and economic trends to the ECB’s QE programme. The bulk of the rise in non-financial M1 growth, however, occurred over 2012-14 before QE started in March 2015. GDP expansion had also strengthened significantly before the QE launch – two-quarter GDP growth, indeed, peaked at 1.25% (2.5% annualised) in the first quarter of 2015. ECB interest rate cuts and lending to the banking system, and the slow repair of bank balance sheets, have probably been the key drivers of strengthening money trends.

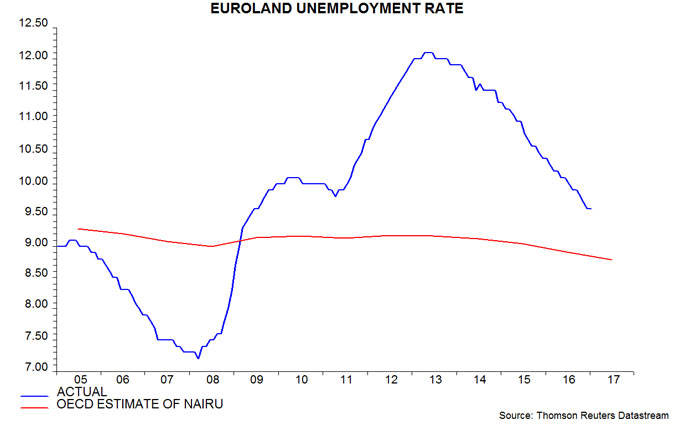

Six-month real non-financial M1 growth is close to its average since 2013, a period during which GDP expanded by 1.7% per annum (i.e. between the fourth quarters of 2013 and 2016). The Eurozone unemployment rate fell by 0.8 percentage points per annum between end-2013 and end-2016. Current monetary trends, therefore, suggest GDP growth of about 1.75% during 2017 and a fall in the jobless rate from 9.6% at end-2016 to below 9% at end-2017. This would be close to the OECD’s estimate of the “NAIRU” (non-accelerating-inflation rate of unemployment) – fourth chart.

Such a scenario suggests rising pressure on the ECB to accelerate its “exit strategy”. In the US, the FOMC halted QE in October 2014 when the unemployment rate was 0.5 percentage points above the mid-point of the Committee’s "central tendency" range for the long-run equilibrium rate (i.e. 5.9% versus 5.35%). It began hiking rates in December 2015 as the jobless rate converged with this mid-point (by then reduced to 4.9%). If the ECB were to behave similarly, it might end QE in summer 2017 and raise rates at the start of 2018. It might, however, choose to reverse the order and lift rates first, on the view that an abrupt end to QE would risk undermining peripheral bond markets.

Reader Comments