Liquidity positives for equities

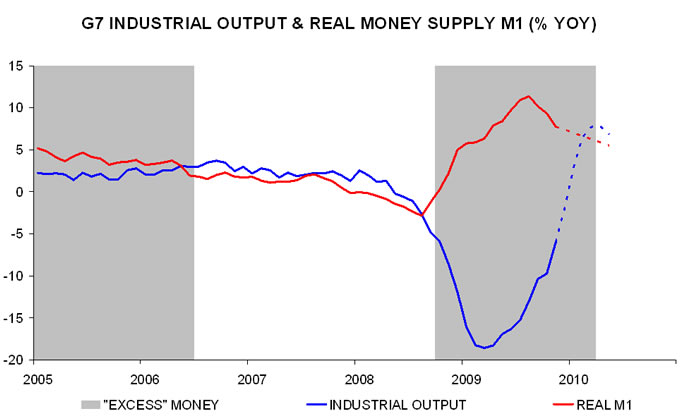

First, the annual rate of change of G7 real money supply M1 remains far above that of industrial output. As detailed in a previous post, world equities have outperformed dollar cash by 11.1% per annum on average when this condition has been met. Real money growth, however, could cross below output expansion this spring – see first chart.

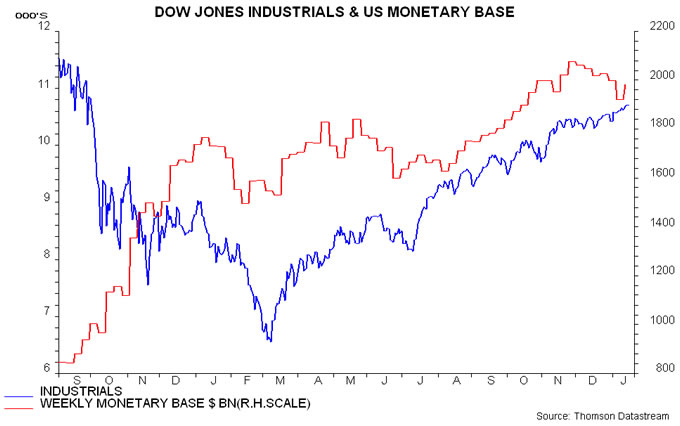

Secondly, the US monetary base, having fallen in late 2009, is rebounding – second chart. A Wall Street Journal article last year by Andy Kessler argued that changes in the Fed's liquidity policy, reflected in the monetary base, were driving equities and other markets. The decline from late November was the result of a build-up of cash in the US Treasury's "general account" at the Federal Reserve, partly due to repayments of TARP funds; this reduced banks' reserves at the Fed. The Treasury, however, is now deploying this cash, reversing the impact: the general account balance rose from $13 billion on 25 November to $167 billion on 6 January but had fallen to $124 billion by 13 January.

Thirdly, US Treasury yields have fallen since the start of the year as investors have pushed back expectations for Fed tightening in the wake of last week's December employment report. The two-year yield is down by about 25 basis points.

Fourthly, US retail interest in equities remains muted but could pick up as economic news continues to improve. Equity mutual funds suffered a further outflow in December and early January, in contrast to substantial – but slowing – buying of bonds.

Reader Comments