Entries from March 10, 2024 - March 16, 2024

Why UK payrolls data could be misleading economy bulls

Perceptions of UK labour market “resilience” rest partly on continued growth in the payrolled employees series, based on PAYE data. This series, however, is likely to have been boosted by a rise in the proportion of self-employed people included in PAYE.

Labour Force Survey (LFS) employment is, at least in concept, the most comprehensive measure of employed people, including all employees and self-employed. The payrolled employees series covers most employees* along with self-employed people who receive pay through PAYE. The latter group includes business owners who choose to draw a salary, contractors on the payroll of the client and self-employed people with second jobs as employees.

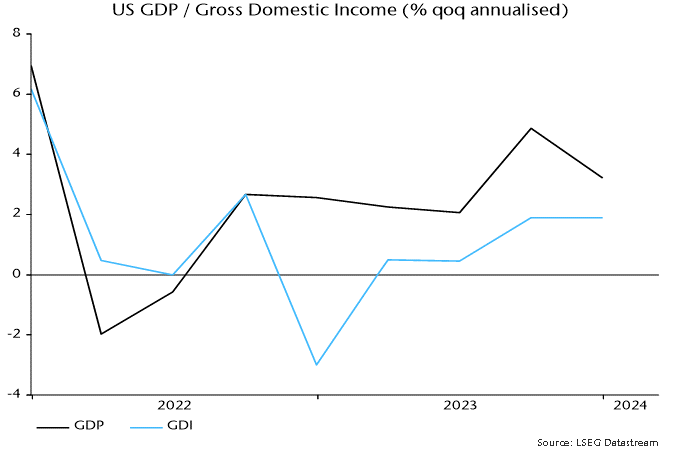

LFS employment peaked in the three months to April 2023, standing 150,000 below that level in the three months to January. This is consistent with GDP / gross value added data indicating a recession starting in Q2 2023.

The payrolled employees series, by contrast, grew by 270,000 over the same interval.

This continues a longer-term divergence. LFS employment in the latest three months was 85,000 above its pre-pandemic peak, reached in the three months to February 2020. Payrolled employees have increased by 1.3 million since then – see chart 1.

Chart 1

There are two reasons for suspecting that the payrolled employees series has been swollen by increased PAYE coverage of the self-employed. First, reform of IR35 rules in the private sector in April 2021 are likely to have resulted in some contractors being moved onto clients’ payrolls.

Secondly, the number of employee jobs has risen by more than employee numbers, suggesting a rise in multiple job-holding**. This may have resulted in some people identifying as self-employed in the LFS being picked up in PAYE.

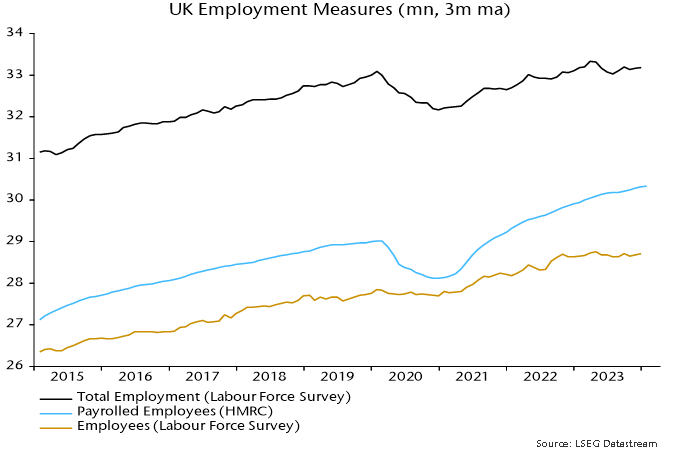

LFS self-employment was 4.33 million in the three months to January. A rough guide to the number included in PAYE is the difference between the payrolled employees series and the LFS measure of employees – 1.6 million.

Chart 2 shows that the latter differential mirrored changes in LFS self-employment until early 2021. It then embarked on a rising trend while LFS self-employment moved sideways. The timing is consistent with an impact from the IR35 reform.

Chart 2

The rise in the payrolled employees / LFS employees differential is unlikely to be solely attributable to increased PAYE coverage of the self-employed. The decline in quality of LFS data due to a falling response rate may have been associated with underrecording of growth in employee numbers.

The payrolled employees series, nevertheless, warrants a health warning and its relative strength should be at least partly discounted, particularly as it jars with other evidence including an ongoing fall in vacancies, rising claimant unemployment, weak REC jobs reports and a recent increase in redundancies.

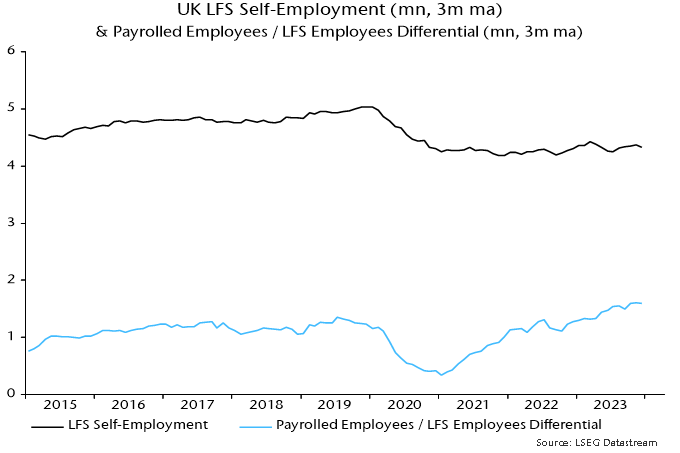

Addendum: Falling US temporary help services employment has been a harbinger of weakness in aggregate payrolls historically. UK LFS temporary employment has a patchier record as a leading indicator but a plunge since the summer is eye-catching – chart 3.

Chart 3

*It does not include employees of companies paying below the national insurance lower earnings limit.

**The Workforce Jobs dataset shows a rise in employee jobs of 1.79 million between Q4 2019 and Q4 2023 versus a 955,000 increase in the LFS measure of employee numbers over the same period.

Weaker US business money trends

The Fed’s quarterly financial accounts provide information on sector money trends and funds flows. Several features of the Q4 accounts, released last week, are noteworthy.

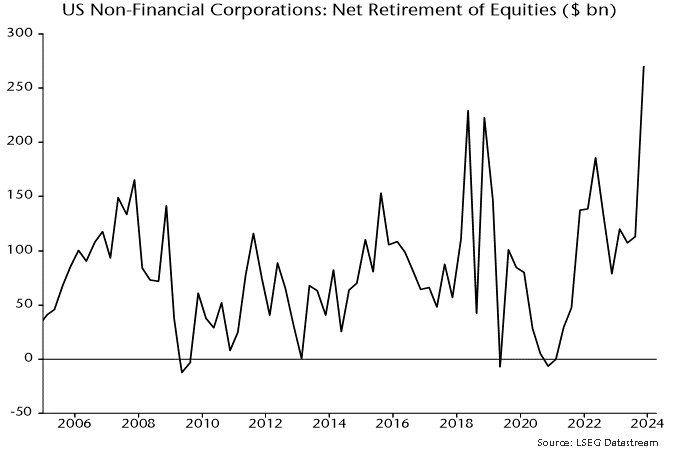

First, net retirement of equities by non-financial corporations (via buy-backs and cash take-overs) reached a record dollar amount ($270 billion) in Q4, confirming that corporate buying was a key driver of the year-end rally – see chart 1.

Chart 1

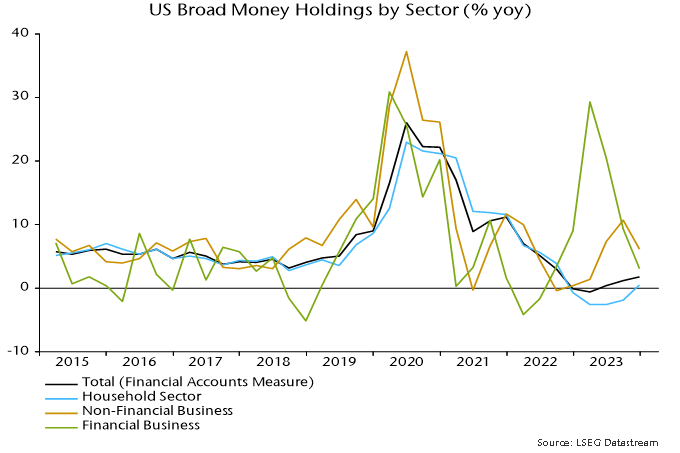

The rise in equity purchases followed strong growth of non-financial business broad money holdings in the year to end-Q3, discussed in a previous post. Such holdings, however, contracted slightly in Q4, pulling annual growth down from 10.6% to 6.2% – chart 2.

Chart 2

Financial business money holdings had surged in the year to end-Q1 2023, perhaps partly reflecting cash-raising related to equity market weakness in 2022. These balances were run down during H2, though still finished the year slightly higher than at end-2022.

The recent weaker trends in non-financial and financial business money suggest less buying support for equities and other risk assets going forward.

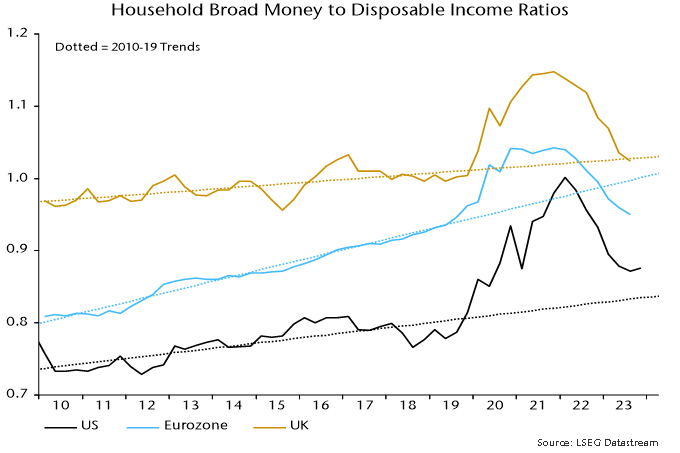

Household broad money, by contrast, rose solidly in Q4, resulting in the annual change returning to positive territory. The ratio of money holdings to disposable income recovered slightly following six consecutive quarterly declines, remaining above its pre-pandemic trend, in contrast to shortfalls for corresponding Eurozone and UK ratios – chart 3.

Chart 3

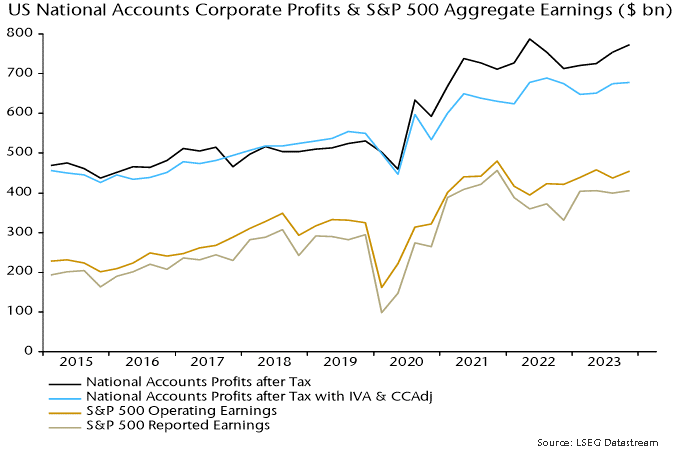

The Q4 financial accounts also contain initial estimates of corporate profits and gross domestic income (GDI). Profits after tax adjusted for stock appreciation and economic depreciation rose at a 2.5% annualised rate last quarter and remain below a peak reached in Q3 2022 – chart 4, blue line. The range-bound movement is consistent with S&P 500 earnings data and questions perceptions of economic / profits strength.

Chart 4

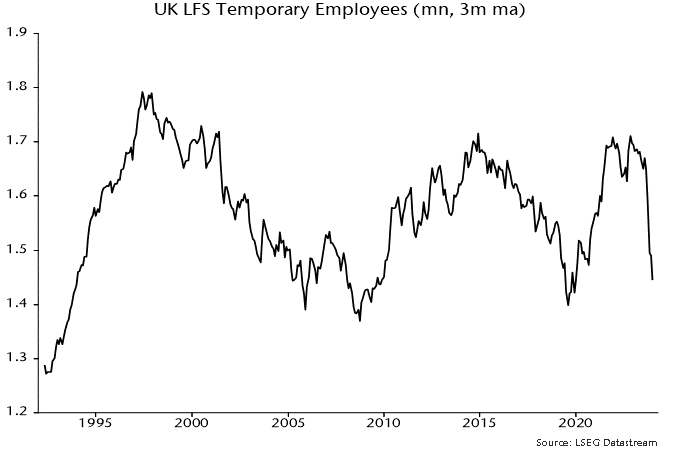

GDI is an alternative estimate of GDP and has consistently lagged the headline expenditure-based measure in recent quarters – see previous post. It did so again in Q4, rising at a 1.9% annualised rate versus headline GDP growth of 3.2% - chart 5. GDI grew by just 1.2% in the year to Q4.

Chart 5