Entries from September 24, 2023 - September 30, 2023

Eurozone / UK inflation tracking optimistic "monetarist" forecast

Eurozone / UK CPI momentum continues to normalise in line with the profile of broad money growth two years ago, a relationship suggesting a return of annual inflation to target in 2024 and an undershoot in 2025.

The six-month annualised rate of increase of Eurozone consumer prices (ECB seasonally adjusted measure) was stable at 3.3% in September but core momentum (i.e. excluding energy, food, alcohol and tobacco) posted another hefty fall from 4.0% to 3.4%, the lowest since January 2022 – see chart 1.

Chart 1

The current rates of increase are consistent with broad money momentum two years earlier: six-month growth of non-financial M3 had slowed significantly but still ran at about 6% annualised during H2 2021.

Broad money growth of 4-5% pa is compatible with the 2% inflation target over the medium term. (The ECB’s “reference value” for M3 growth under the now-demolished monetary pillar was 4.5% pa.) Six-month momentum moved into this range from Q2 2022, suggesting that the six-month rise in prices will return to about 2% annualised around Q2 2024, with annual inflation following later in the year.

The six-month rate of change of broad money broke decisively below 4% annualised in early 2023, moving into contraction in May. The message is that CPI momentum is on course to undershoot in 2025 unless the ECB reverses policy tightening and generates an early / significant rebound in money momentum.

The six-month annualised rate of increase of UK seasonally-adjusted consumer prices slowed sharply in August but was still above the Eurozone level, at 4.4% versus 3.3% – chart 2. UK and Eurozone six-month broad money growth was identical in August 2021 (6.1% annualised) but earlier strength had been more extreme in the UK, possibly contributing to higher current inflation.

Chart 2

Six-month broad money momentum, however, fell more sharply in the UK than the Eurozone in late 2021, while the UK increase broke below 4% annualised six months earlier, in July 2022. The suggestion is that the UK inflation decline will catch up with or move ahead of Eurozone progress over the next six to 12 months.

Hard landing watch: September surveys

This is the first of a series of short posts focusing on whether incoming economic news supports or contradicts the forecast of a global “hard landing” suggested by monetary trends.

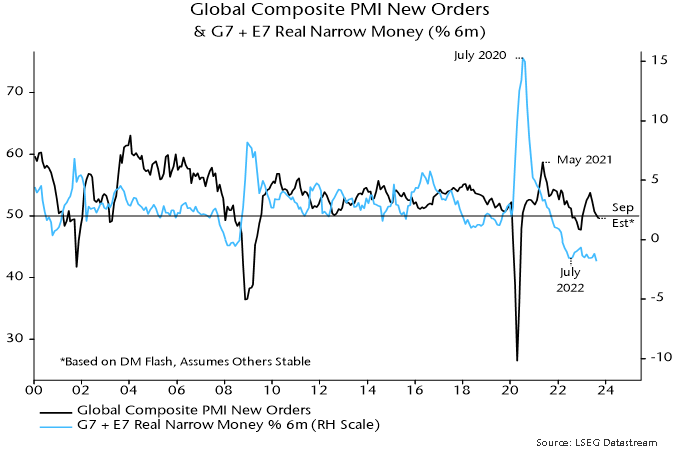

Flash results suggest that the global composite PMI new orders index – a timely indicator of demand momentum – fell for a fourth month in September, consistent with the monetary signal of a slide into early 2024, at least.

The flash results, available for the US, Japan, Eurozone, UK and Australia, imply a decline through 50 to the lowest level since December, assuming no change in all other countries in the global aggregate – see chart 1.

Chart 1

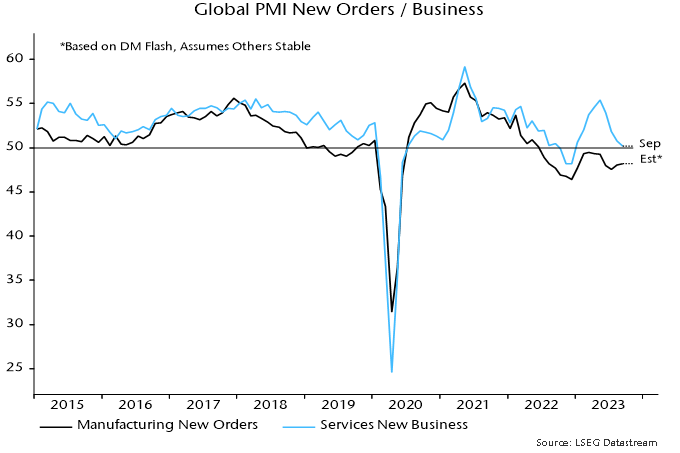

Weakness in the flash surveys was driven by a further slowdown in services new business, with manufacturing new orders little changed – chart 2.

Chart 2

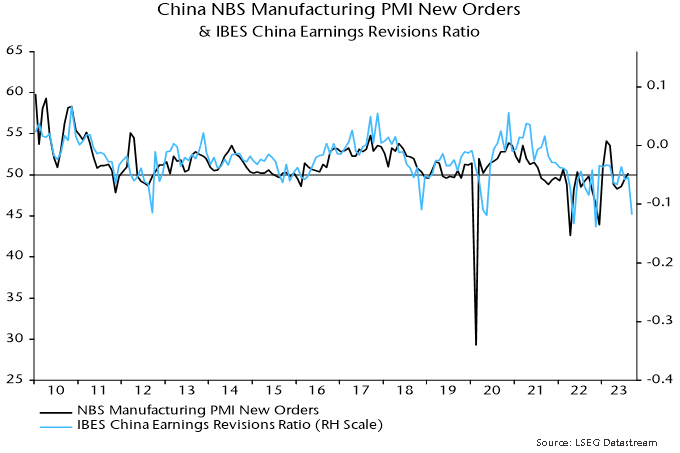

Any hopes of manufacturing stabilisation, however, may be dashed by full September results incorporating China and other emerging economies. The equity analysts’ earnings revisions ratio correlates with Chinese manufacturing PMI new orders and weakened sharply this month – chart 3.

Chart 3

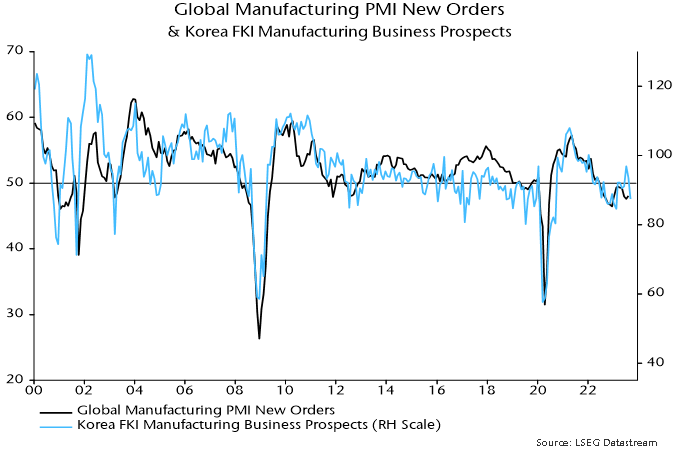

Renewed deterioration in Chinese / Asian manufacturing is also suggested by the Korean FKI survey for September, showing a relapse in the assessment of business prospects to the weakest since February – chart 4.

Chart 4