Entries from January 16, 2022 - January 22, 2022

Don't exaggerate UK labour market "strength"

The UK labour market has recovered impressively but isn’t at risk of “overheating”, as claimed by economists quoted in write-ups of this week’s data.

The number of payrolled employees is at a record but this partly reflects a large number of self-employed people switching to employee status during the pandemic. The comprehensive Labour Force Survey measure of employment remains 600,000 below its peak – see chart 1.

Chart 1

The unemployment rate for the 16-64 age group of 4.2% is almost back to its pre-pandemic low of 3.8% but has been suppressed by a rise in inactivity, which is 1.2 pp higher as a share of the labour force, i.e. the jobless rate would be 5.4% if inactivity had remained stable – chart 2.

Chart 2

High inflation is putting upward pressure on wage settlements but the six-month growth rate of regular earnings (i.e. excluding bonuses) is currently no higher than in mid-2019, at 3.7% annualised – chart 3.

Chart 3

Weak / negative real money growth is likely to be reflected in a loss of economic momentum, implying labour market cooling – chart 4. Vacancies lead and may be peaking – chart 5.

Chart 4

Chart 5

Has the Fed called the top in growth (again)?

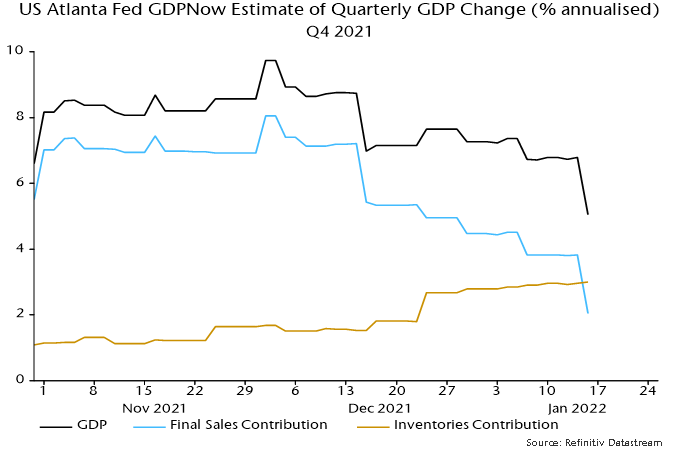

Recent US economic news has surprised negatively when properly weighted for significance. The Atlanta Fed’s nowcast of the contribution of final sales to Q4 annualised GDP growth has been slashed from 8.1 percentage points at the start of December to just 2.0 pp currently – see chart 1.

Chart 1

The most recent lurch down was driven by shockingly bad December retail sales – inflation-adjusted sales have now dropped 10% from their stimulus-inflated March peak.

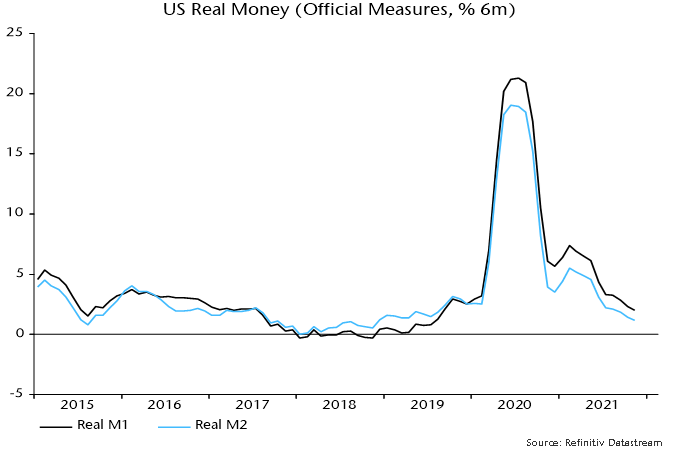

The consensus is discounting weakness as temporary and due to the omicron wave. The “monetarist” forecast is that a cyclical slowdown is under way related to a big fall in real money growth since 2020 – chart 2.

Chart 2

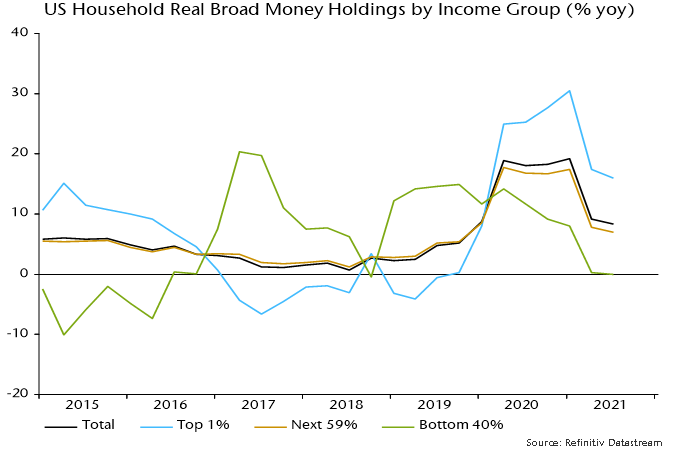

The distribution of money growth, moreover, looks unfavourable for demand growth. Broad money balances have risen fastest for high-income households with a lower propensity to consume. Money holdings of the bottom 40% of earners were stagnant in real terms in the year to end-Q3 – chart 3.

Chart 3

The Atlanta Fed’s Q4 GDP growth nowcast is still up at 5.0% but this reflects a whopping 3.0 pp contribution from inventories – consistent with the view here that the stockbuilding cycle is peaking.

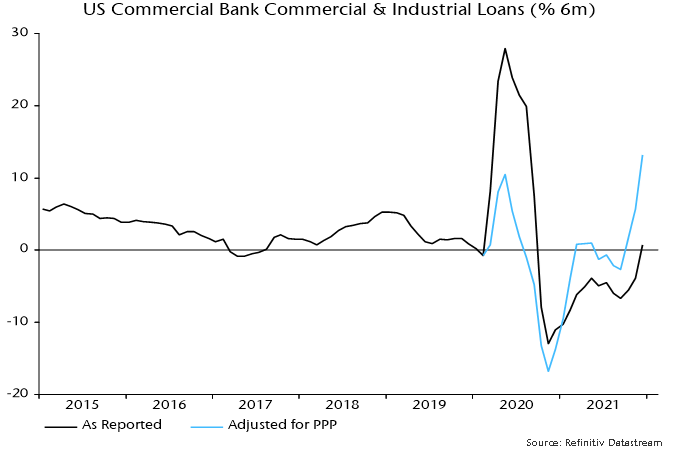

The latter estimate is based on inventory data through November but the December retail sales slump suggests further stockpiling. So does another bumper monthly rise in commercial and industrial loans, which are strongly influenced by inventory financing needs – chart 4.

Chart 4

The Fed’s “hawkish pivot” was predicated on a strong economy* but the Fed is often facing the wrong way at turning points. Officials are likely to row back if activity data continue to disappoint, even if inflation news remains unfavourable.

*From Chair Powell’s testimony to the Senate Banking Committee on 11 January: ”Today the economy is expanding at its fastest pace in many years, and the labor market is strong.”

Equity rotation consistent with liquidity squeeze

The violent rotation in equity markets since the start of the year appears to have been driven by a tightening of liquidity conditions hitting high-flying growth stocks, rather than signalling increased economic optimism and a resumption of the late 2020 / early 2021 “reflation trade”.

The price relative of MSCI World value to growth surged 8.1% between 31 December and last week’s close, reaching its highest level since June. The relative of non-tech cyclical sectors to defensive sectors was up by “only” 1.4% over this period and remains below a November secondary peak – see chart 1.

Chart 1

The behaviour of the cyclical to defensive sectors relative is consistent with the view here that the global manufacturing PMI new orders index is in a downtrend – chart 2. This relative has displayed a much stronger correlation with the PMI historically than value vs. growth.

Chart 2

Global six-month real narrow money growth leads the PMI and is estimated to have been little changed in December from November’s 27-month low. The suggestion is that the PMI will move lower in H1 with no recovery before Q3 at the earliest – chart 3.

Chart 3

The view that equity market moves reflect liquidity tightening rather than reflation optimism is supported by the stability of Treasury market breakevens and a rising real yield – chart 4.

Chart 4

As previously discussed, both measures of global “excess” money tracked here are now negative for the first time since 2019.

On this view, the Fed’s “hawkish pivot” has been coincident with rather than the key driver of tighter liquidity.

Growth stocks may continue to suffer near term but the forecast of a global economic slowdown suggests approaching liquidity relief. The rally in the cyclical vs. defensive sectors relative, meanwhile, may reverse as activity news disappoints.