Entries from January 12, 2020 - January 18, 2020

Is China recovering?

Chinese official activity data for December mostly surprised positively, echoing an earlier PMI revival. With the PBoC cutting reserve requirements further at the start of the year, local governments stepping up issuance of infrastructure bonds and a “phase 1” US-China trade deal now concluded, is the economy on track to recover in H1 2020?

Monetary trends suggest not. Six-month growth rates of the narrow and broad money measures followed here were little changed in December, having fallen since Q2 2019. Credit expansion also remained cool – see first chart. (Note: the GDP numbers used in this chart were subsequently changed - see here.)

The “monetarist” interpretation is that the improvement in economic data at year-end reflected a recovery in money growth in early 2019, which went into reverse after the first of several regional bank failures in May and an associated tightening of credit conditions. The post-Q2 monetary slowdown suggests a relapse in economic data from Q1 2020.

The US-China trade deal locks in the bulk of recent tariffs, probably until 2021 (or later), and may result in President Trump redirecting his protectionist energies towards Europe.

Will the latest PBoC reserve requirement ratio cut, along with better economic data and additional fiscal spending, result in an easing of credit conditions in early 2020? The CKGSB corporate financing index for January, released towards month-end, will be an important data point: it continued to soften in December – second chart. Any recovery in credit conditions and money growth in early 2020, though, would be unlikely to be reflected in economic data until late in the year.

UK inflation slump piles pressure on tardy MPC

The forecast here a year ago was that the MPC would cut Bank rate to 0.5% during 2019. This was wrong in fact but right in spirit, as reflected in a significant downward shift in the yield curve.

The expected cut was probably pushed back by Brexit and election uncertainty but recent MPC communications and this week’s weak GDP and inflation data suggest that it will be delivered on the 30 January decision date.

The consensus thinks that a big enough bounce in January flash PMIs released next Friday could yet persuade the MPC to hold fire. This is doubtful and Tuesday’s labour market report may be more important – confirmation that employment has stalled and earnings growth is cooling would probably cement a January cut.

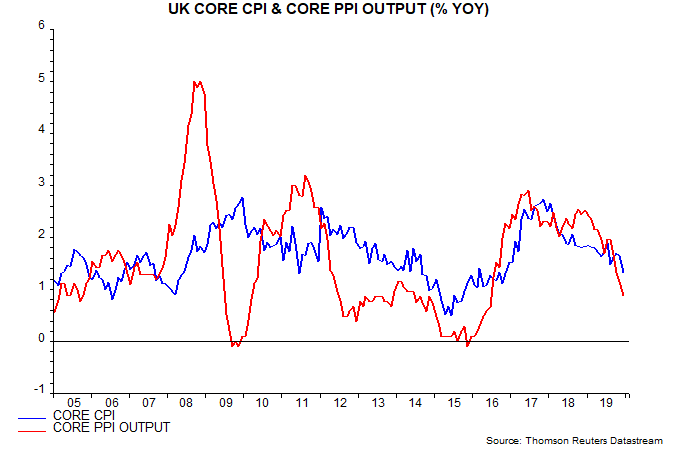

The volatile air fares component contributed to a decline in core CPI inflation to 1.4% (1.37%) in December, a three-year low, but there were also downward moves in food, non-energy industrial goods and recreational and personal services. A November post suggested that the core rate would fall further based partly on a lagged relationship with core producer output price inflation, which continued to plunge last month – see first chart.

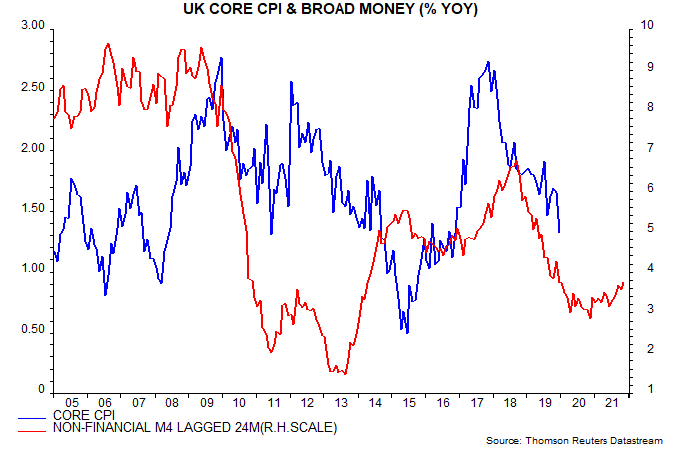

From a causal perspective, inflationary pressures are ebbing in lagged response to a fall in annual broad money growth – as measured by non-financial M4 – from nearly 7% in late 2016 to below 3% in late 2018: the monetarist rule of thumb is that money trends lead prices by about two years on average, although the relationship can be temporarily disrupted by large exchange rate swings (such as the post-EU-referendum depreciation) – second chart. The suggestion is that core inflation will continue to ease through 2020 barring a sizeable fall in sterling.