Entries from August 11, 2019 - August 17, 2019

Labour market watch: gathering UK weakness

According to Gluskin Sheff economist David Rosenberg, recessions in the US “historically begin when the unemployment rate climbs 0.4 percentage points above its cycle low”. The UK single-month unemployment rate rose from a low of 3.7% in May to 4.1% in June, raising a recession warning flag.

The UK single-month rate is based on a small sample and is much more volatile than its US counterpart. A monthly rise of this size, however, is unusual: excluding the 2008-09 recession, an increase of 0.4 pp or more occurred in only 4% of months between July 1992 (the earliest available data point) and May 2019.

The ONS surveys largely the same group of individuals every three months, suggesting focusing on the three-month change in the single-month unemployment rate rather than the month-on-month change. The three-month increase was 0.3pp in June, the highest since 2015.

The suggestion of a trend reversal in unemployment is supported by an ongoing decline in the stock of job vacancies, which were down by 4.8% in July from six months earlier (three-month moving average). The six-month change is the most negative since the double-dip recession scare of 2011-12 – see first chart.

Other recent labour market developments have a recessionary flavour, including a fall in the employment shares of full-time workers and employees, a stagnation in total hours worked and a faster drop in temporary working. Part-time employees and the “self-employed” account for all of the rise in total employment over the last six months.

The consensus has played down the 0.2% Q2 GDP fall as payback for Q1 strength due to Brexit stockpiling. Two-quarter growth, however, declined to 0.3%, a post-GFC low, and corporate money trends are signalling a further slide to zero or negative during H2 – second chart. A recession remains the baseline scenario here regardless of Brexit developments.

Chinese policy easing still isn't working

Chinese July money numbers were very disappointing, signalling that an economic recovery remains distant. More decisive monetary policy easing is urgently required but the authorities are constrained by a teetering RMB and surging food prices.

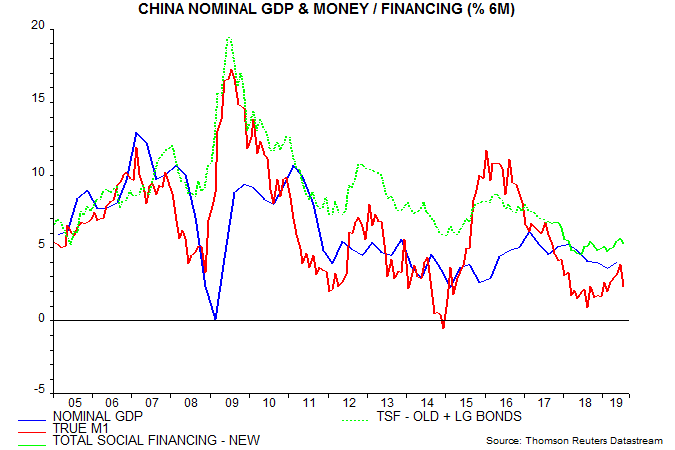

Six-month growth of narrow money dropped sharply in July, reversing a four-month improvement – see first chart. Broad money growth (not shown) was similarly weak. Broad credit expansion registered a smaller decline but had recovered by less previously.

Money / credit growth in real terms – i.e. relative to consumer prices – was additionally depressed by a rise in six-month inflation to an eight-year high, reflecting strong food prices, which were up by 9.1% in July from a year earlier. Real narrow money growth dropped back to near its late 2018 low – second chart.

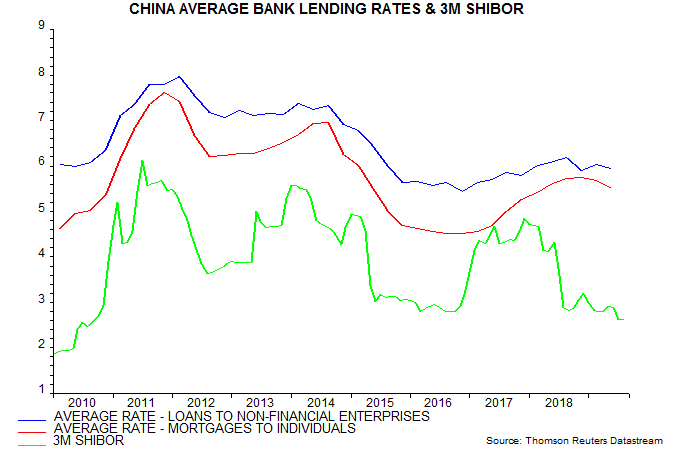

Money / credit trends are weak mainly because a policy-driven fall in money market rates has not been transmitted to the wider economy. Average interest rates on banks’ enterprise loans and mortgages remained elevated in Q2, according to the PBoC’s just-released monetary policy report – third chart.

The limited pass-through may partly reflect official guidance to banks to avoid another lending splurge. In addition, the failure of Baoshang Bank in May resulted in a rise in funding costs for smaller institutions.

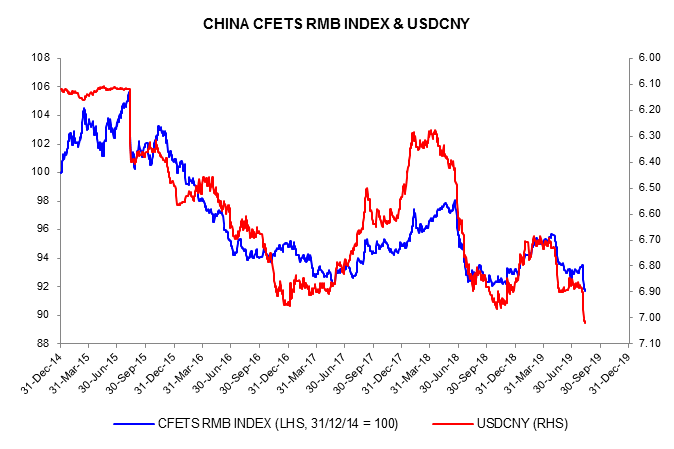

The authorities are relying on fiscal stimulus to boost the economy but may be forced to reopen the credit sluice gates. Such action, however, risks cratering the currency. As well as falling through 7 against the US dollar, the RMB has now breached 2017-18 lows against the official currency basket – fourth chart.