Entries from July 21, 2019 - July 27, 2019

Euroland PMI weak but money trends still hopeful

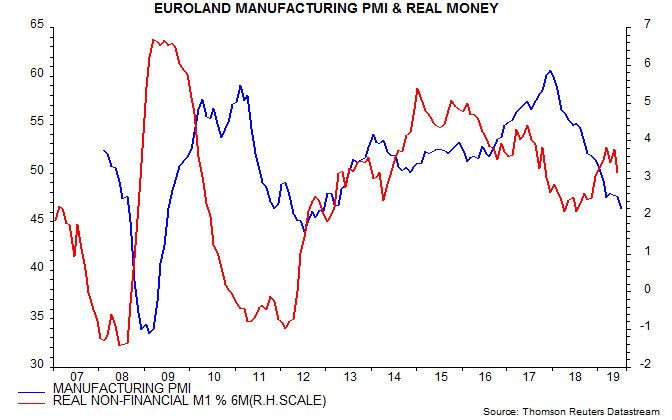

The Euroland manufacturing PMI fell further in July but the view here remains that the index is bottoming, based on the leading signal from a rise in six-month real narrow money growth since late 2018 – see first chart.

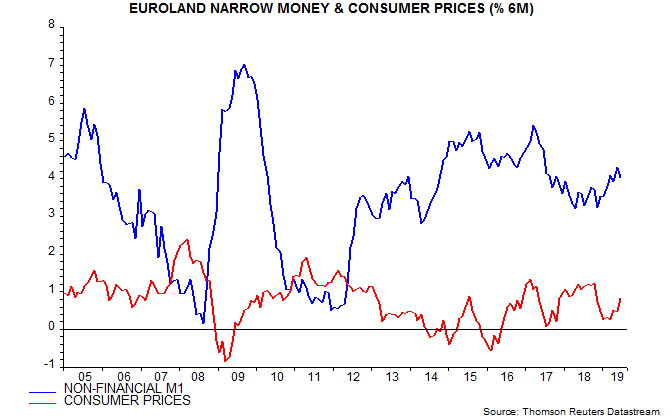

Real money growth, admittedly, slipped back in June (data also released today) but this mainly reflected a further pick-up in six-month inflation, which is probably peaking – second chart. Nominal narrow money growth has moved sideways recently.

Real narrow money growth remains stronger than in other major economies.

The further fall in the PMI may have been driven by firms paring excess inventories, resulting in a reduction in orders on suppliers. Orders will normalise higher when this process ends – even with unchanged final demand. This could be imminent: the ratio of new orders to inventories remained above its recent low in July despite the further decline in orders.

While industrial momentum could be bottoming, the latest money numbers suggest a subdued economic outlook, implying softer labour markets and a continued inflation undershoot. The composite PMI, moreover, could decline further as services catch up with manufacturing weakness.

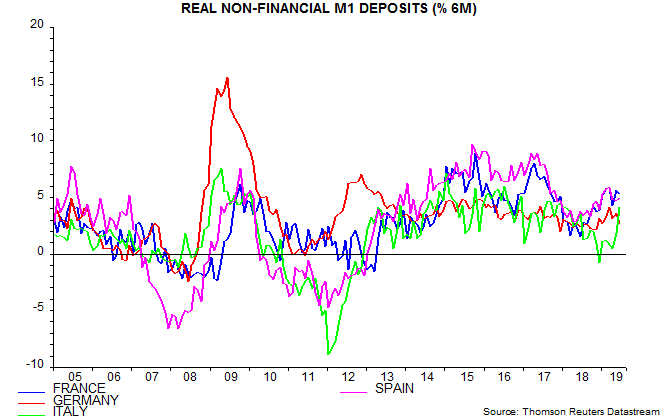

Country data show that real narrow money growth remains stronger in France and Spain than Germany, suggesting superior economic prospects – third chart. A sharp rise in Italian growth in June mainly reflected a positive base effect and should unwind next month.

US C&I loans confirming inventory downswing

Three-month growth of US commercial bank loans and leases fell from 1.5% (6.3% annualised) in February to 0.9% (3.5%) in June, reflecting a sharp slowdown in commercial and industrial (C&I) lending – see first chart.

The demand for C&I loans is closely related to the stockbuilding or inventory cycle. The lending slowdown adds to other evidence, discussed in Friday’s post, that the US / global cycle is weakening rapidly towards a low likely to be reached during the second half of the year.

The second chart shows the contribution of stockbuilding to annual GDP growth together with the annual change in three-month growth of C&I loans. The relationship suggests that the change in inventories will be a significant drag on Q2 GDP, to be released on Friday.

The Q2 report will incorporate annual revisions, which may resolve the recent large divergence between the headline (expenditure) and income measures of GDP. According to current data, headline GDP rose at a 2.6% annualised rate in the fourth and first quarters combined versus growth of only 0.8% in the income measure – the latter weakness is consistent with a stagnation of real narrow money in the year to November 2018.