Entries from March 26, 2017 - April 1, 2017

UK data wrap: positive current account surprise

UK monthly sectoral output numbers suggest that quarterly GDP growth will slow to 0.4-0.5% in the first quarter from 0.7% in the fourth quarter. GDP price data, meanwhile, confirm a pick-up in domestic inflationary pressures, with the annual rise in the GDP deflator unrevised at 2.8% in the fourth quarter. The current account deficit fell sharply last quarter, reflecting stronger trade performance in both goods and services and a further fall in net income paid abroad.

Highlights of today’s batch of data releases include:

-

GDP fell by 0.2% between December and January to stand 0.3% above the fourth-quarter level. The decline spanned sectors, with services, industrial and construction output down by 0.1%, 0.4% and 0.4% respectively. The soft start to the quarter suggests downside risk to the Bank of England staff “nowcast” of 0.6% growth in the first quarter at the time of the March MPC meeting.

-

Services output growth in the third and fourth quarters was revised down slightly, resulting in a reduction in third-quarter GDP expansion from 0.6% to 0.5% with fourth-quarter growth unchanged at 0.7% rather than revised up (as earlier data had suggested).

-

The 2.8% annual rise in the GDP deflator in the fourth quarter was the strongest since 2008. The gross value added deflator – which excludes indirect taxes and subsidies – was up by 2.6%. Measured from the income side, employee compensation per unit of output rose by 2.3%, while the unit contribution of profits, rents and other income was up 3.1%. These numbers confirm that the current inflation pick-up has a significant domestic element.

-

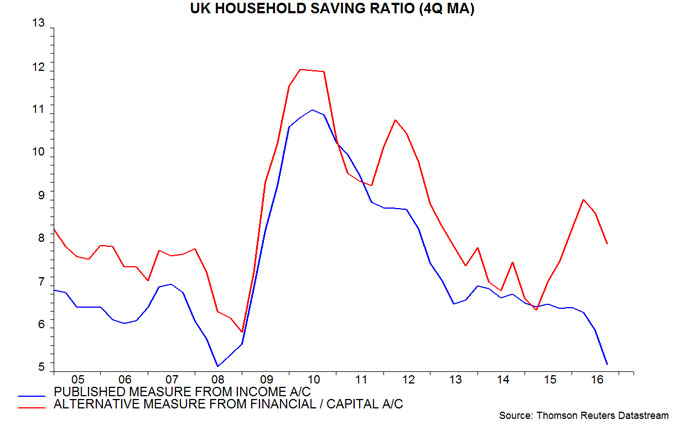

The official measure of the household saving ratio fell to 5.2% in 2016 and 3.3% in the fourth quarter, a record low in data extending back to 1963. An alternative measure of the saving ratio derived from the financial / capital accounts remains significantly higher than the official series, giving a more favourable impression of consumer finances, but also declined last year – see first chart below and previous post for more details.

-

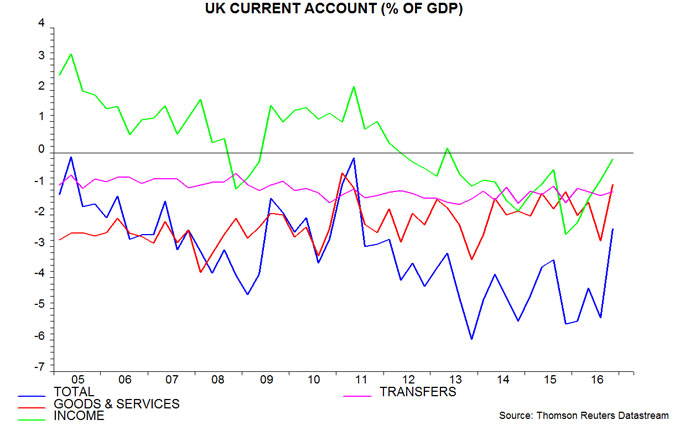

The current account deficit fell from 5.3% of GDP in the third quarter to 2.4% in the fourth, reflecting a smaller trade shortfall in goods and services and a further decline in the income deficit to the lowest since 2013 – second chart. The services trade surplus matched a previous record 5.4% of GDP last quarter as exports – particularly to non-EU countries – continued to grow robustly. The recent decline in the income deficit has been driven by a strong recovery in foreign direct investment earnings probably mainly due to the translation effect of sterling weakness and higher oil prices / profits – fourth-quarter earnings were up by 64% from a year earlier.

-

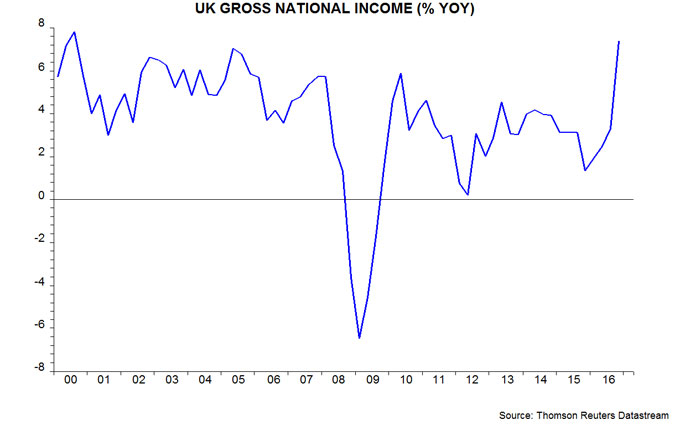

The combination of solid output expansion, accelerating domestic prices and a big decline in net income paid abroad resulted in gross national income surging by 7.4% in the year to the fourth quarter, the strongest annual increase since 2000 – third chart.

UK real money squeeze suggesting late 2017 weakness

UK narrow and broad money trends have weakened since the autumn, with rising inflation acting as a further drag on real-terms expansion. Allowing for the usual six to 12 month lag, this suggests that the economy will expand respectably through mid-2017 but slow sharply in the second half.

UK money trends are diverging negatively from those in the Eurozone. As noted in Monday’s post, annual growth of Eurozone narrow and broad money – as measured by non-financial* M1 and non-financial M3 – rose to 10.0% and 5.8% respectively in February, representing 16-month and eight-year highs. In the UK, by contrast, annual non-financial M1 growth peaked at 10.2% in September 2016 and fell to 8.6% in February, an 11-month low. Broad money growth – as measured by non-financial M4 – declined from 6.8% to 5.4% over the same period. The change of trend suggests that the recent pick-up in nominal GDP expansion will tail off and reverse later in 2017 – see first chart.

Shorter-term money trends signal a likely further decline in annual expansion. Non-financial M1 rose by 3.5%, or 7.2% at an annualised rate, in the six months to February, with non-financial M4 up by 2.0%, or 4.0% annualised. With consumer prices accelerating, six-month real growth of the two measures is the lowest since 2012 and 2011 respectively – second and third charts.

Why has money growth slowed? The demand to hold narrow money is influenced importantly by spending intentions, explaining why it leads the economy. Households and firms may be scaling back spending plans in response to Brexit uncertainty and rising prices / costs, with these negatives outweighing favourable global economic conditions. Real M1 holdings of households and private non-financial corporations (PNFCs) have slowed similarly, suggesting weaker prospects for both consumer spending and business investment – fourth chart.

Broad money fluctuations are viewed here as being driven by supply-side influences such as credit trends and balance of payments flows in the short run, with demand adjusting to supply further out. The recent slowdown appears to reflect a moderation of lending growth – second chart – and a rise in banks’ non-deposit funding. To the extent that the September-February QE programme had any positive impact, it was more than offset by other factors.

The MPC is now in a stagflationary bind of its own making. The failure to act to check rising money growth in 2015-16 suggests upward pressure on inflation through late 2018, at least – see previous post. Belated policy action, however, will be presentationally and politically difficult against the backdrop of a second-half economic slowdown suggested by real money trends. A possible scenario is that the MPC will make a token reversal of its ill-advised August rate cut later in 2017 while relying on the Brexit excuse to deflect blame for poor inflation / growth outcomes and avoid a more significant policy adjustment.

*Non-financial = held by households and non-financial corporations (i.e. excludes financial sector money).

Eurozone money trends arguing for earlier ECB exit

Eurozone narrow and broad money growth remains strong, suggesting a stable, solid economic outlook and rising pressure on the ECB to accelerate its “exit strategy”.

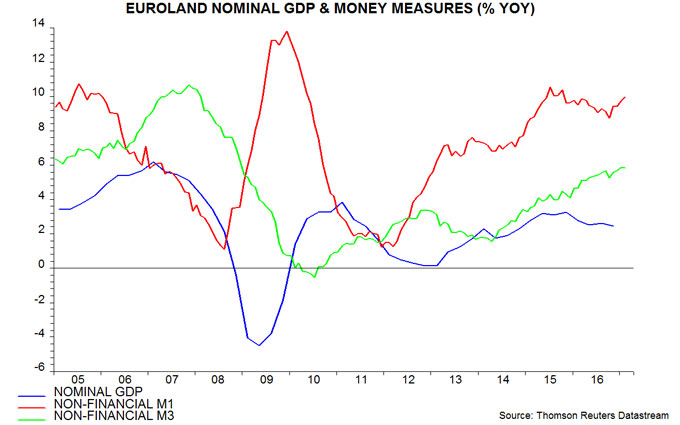

The narrow aggregate non-financial M1 – comprising currency in circulation and overnight deposits of households and non-financial corporations (NFCs) – has the strongest correlation with future GDP growth, according to ECB research. Annual growth of this measure was 10.0% in February, the fastest since 2015. The recent pick-up suggests that nominal GDP expansion will rise through 2017 – see first chart.

The broader non-financial M3 aggregate has also accelerated, with annual growth of 5.8% in January / February the fastest since 2009 – first chart.

The headline M1 and M3 measures include money holdings of financial corporations but these are volatile and contain little information about near-term spending prospects. Analysts focusing on the headline measures are at risk of underestimating future economic growth, as financial sector money has been falling – M1 grew by an annual 8.4% in February (versus 10.0% for non-financial M1) and M3 by 4.7% (versus 5.8% for non-financial M3) – second chart.

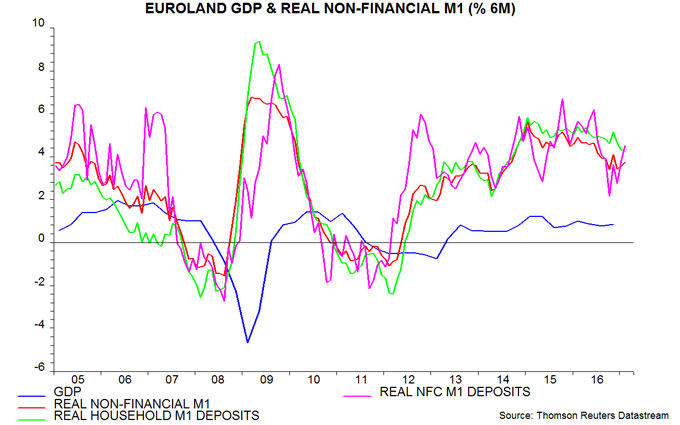

The third chart shows the two-quarter change in GDP and six-month changes in real (i.e. consumer price-deflated) non-financial M1 and its household / NFC deposit components. Real non-financial M1 growth has moderated since mid-2016 but remains solid by historical standards. The recent slowdown has been entirely due to a pick-up in consumer price inflation – nominal money growth has remained buoyant. Both household and NFC real deposits are rising strongly, suggesting solid prospects for consumer spending and business investment.

Some monetary economists attribute favourable monetary and economic trends to the ECB’s QE programme. The bulk of the rise in non-financial M1 growth, however, occurred over 2012-14 before QE started in March 2015. GDP expansion had also strengthened significantly before the QE launch – two-quarter GDP growth, indeed, peaked at 1.25% (2.5% annualised) in the first quarter of 2015. ECB interest rate cuts and lending to the banking system, and the slow repair of bank balance sheets, have probably been the key drivers of strengthening money trends.

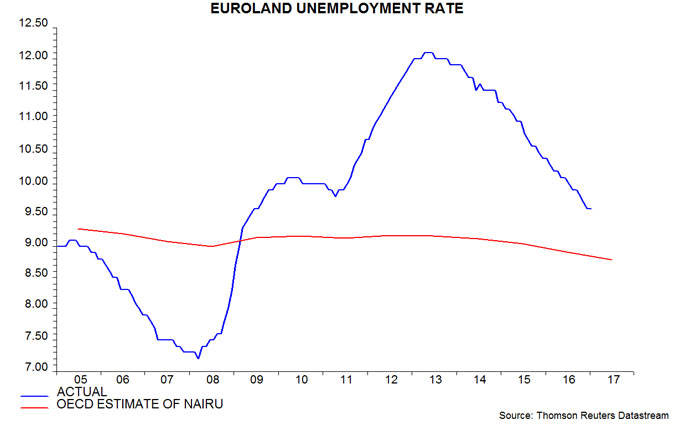

Six-month real non-financial M1 growth is close to its average since 2013, a period during which GDP expanded by 1.7% per annum (i.e. between the fourth quarters of 2013 and 2016). The Eurozone unemployment rate fell by 0.8 percentage points per annum between end-2013 and end-2016. Current monetary trends, therefore, suggest GDP growth of about 1.75% during 2017 and a fall in the jobless rate from 9.6% at end-2016 to below 9% at end-2017. This would be close to the OECD’s estimate of the “NAIRU” (non-accelerating-inflation rate of unemployment) – fourth chart.

Such a scenario suggests rising pressure on the ECB to accelerate its “exit strategy”. In the US, the FOMC halted QE in October 2014 when the unemployment rate was 0.5 percentage points above the mid-point of the Committee’s "central tendency" range for the long-run equilibrium rate (i.e. 5.9% versus 5.35%). It began hiking rates in December 2015 as the jobless rate converged with this mid-point (by then reduced to 4.9%). If the ECB were to behave similarly, it might end QE in summer 2017 and raise rates at the start of 2018. It might, however, choose to reverse the order and lift rates first, on the view that an abrupt end to QE would risk undermining peripheral bond markets.