Entries from September 25, 2016 - October 1, 2016

UK confidence returning, money trends still solid

UK survey and monetary data released today give a positive message about current economic performance and near-term prospects, suggesting no need for further monetary policy easing and questioning the scale of the MPC’s August actions (although Bank of England Governor Carney will try to claim credit for economic resilience).

Annual growth of narrow and broad money rose further in August. The Bank’s M4ex measure is now expanding at a 7.3% annual rate, the fastest since 2008. Stronger money growth has already been reflected in a pick-up in nominal GDP expansion, which may continue to rise into mid-2017, at least – see first chart.

The EU Commission’s monthly business surveys for September, meanwhile, showed further recoveries in confidence in services, retailing and construction. The surveys are mostly conducted by the CBI and the same information is included in the CBI’s expected growth indicator, which has a similar correlation with GDP changes to the more widely-watched composite PMI. Based on the EU data, the CBI indicator is likely to have recovered to a “normal” level in September – second chart.

The EU Commission’s consumer confidence measure also rebounded significantly last month, to a strong level by historical standards – third chart.

Tomorrow’s July services output data will be a key input to the preliminary third-quarter GDP estimate released in late October – see previous post. Based on current information, a quarterly GDP rise of 0.4% looks possible, far above the original Bank staff projection – at the time of the August policy easing – of no change, since revised to an increase of 0.2%.

Returning to the monetary data, the non-financial M1 and M4 measures tracked here rose solidly again in August, by 0.7% and 0.5% respectively. Six-month growth of real non-financial M1 (i.e. deflated by consumer prices) has risen over the past year, though may have peaked in June. Real non-financial M4 growth has been broadly stable. There is no suggestion in these trends of an imminent sharp economic slowdown – fourth chart.

Recent buoyancy in retail spending was signalled by a strong pick-up in six-month real household M1 growth in late 2015 / early 2016. The pace has cooled but remains solid. Real M1 growth of private non-financial corporations (PNFCs), meanwhile, has recovered from a pre-referendum slowdown, suggesting that business expansion plans are holding up better than feared.

The Bank’s M4ex broad money measure rose by only 0.1% in August but this followed a bumper 3.5% increase over the prior three months. The August rise was suppressed by a 2.2% decline in financial institutions’ M4 holdings, following a 14.1% surge over May-July. The latter increase may have partly reflected institutions’ raising precautionary cash before and immediately after the referendum. The August fall would probably have been larger but for the MPC’s decision to restart gilt purchases.

Eurozone money signal still positive

The consensus forecast is for Eurozone GDP growth to slow from 1.5% in 2016 to 1.2% in 2017. Monetary trends suggest that this is too downbeat and GDP will continue to rise at a 1.5-1.75% annual rate – it increased by 1.6% in the year to the second quarter. Such growth would be comfortably above trend economic expansion estimated by international forecasting bodies at about 1% per annum, implying a continued decline in unemployment and – probably – firmer “core” inflation.

Some commentary before today’s release of August data expressed concern about a cooling of monetary trends. Annual growth of narrow money M1 was 8.4% in July, well down from a peak of 11.8% in July 2015, with M3 expansion easing to 4.8%, a three-month low. The August numbers were better, showing annual growth of 8.9% and 5.1% respectively.

The earlier concern was not shared here, on the grounds that the headline M1 / M3 numbers were being pulled down by a decline in growth of financial institutions’ deposits, which contain little information about near-term economic prospects. Annual growth of non-financial M1 – comprising holdings of households and non-financial corporations – was 8.9% in July, increasing to 9.3% in August. Non-financial M3 expansion rose to 5.6% last month, the fastest since 2008 – see first chart.

A further reason for remaining sanguine was / is that earlier policy easing has yet to have its full impact on monetary conditions. Interest rates on new bank loans, for example, are still declining, with potential positive effects on credit demand and monetary expansion – second chart.

Annual growth of bank loans to the private sector remains weak, at 1.7% in August, but is trending gradually higher, with the ECB’s bank loan officer survey signalling rising credit demand – third chart.

Solid monetary growth since 2013 has lifted domestically-generated inflation – as measured by the annual change in the GDP deflator – to 1.1% as of the second quarter, as well as delivering respectable economic expansion. Nominal GDP rose by 2.8% in the year to the second quarter, outpacing increases of 2.4% in the US and 1.5% in Japan, though below a 2.9% UK gain. Eurozone deflation risk was and remains low.

Chinese reflation on track, profits surging

Chinese industrial profits surged in August, providing further confirmation that the economy is strengthening, as signalled by monetary trends since late 2015.

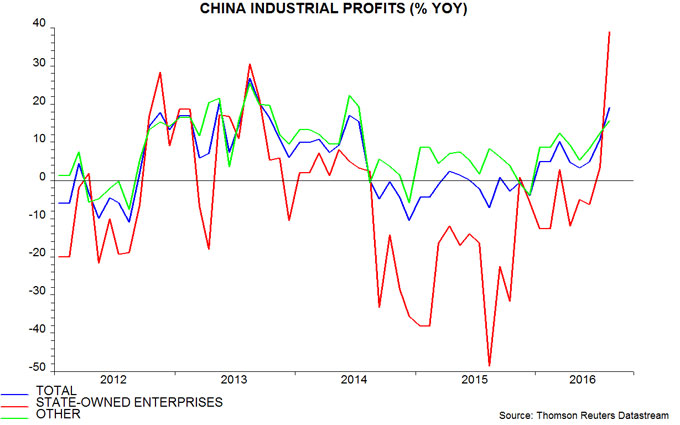

Profits rose by 19% in August from a year before, the fastest annual growth rate since 2013. The August result was flattered by a favourable base effect but underlying growth is well into double-digits. Profits of state-owned enterprises were 39% higher in August than a year before, though had slumped by 49% in the previous 12 months – see first chart.

A fall in profits in 2015 contributed to weakness in private fixed asset investment through summer 2016. Previous posts suggested that this year’s profits rebound, and an accompanying pick-up in growth of enterprise money holdings, would feed through to a revival in investment later in 2016 and in 2017. August investment results provided tentative support for this view, with the annual change in the private component recovering to a four-month high.

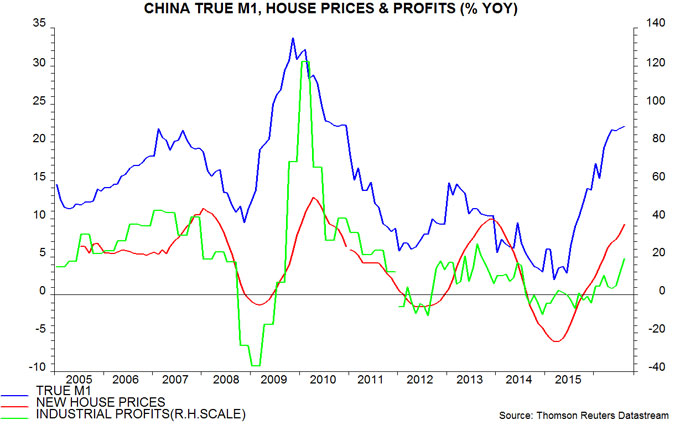

Monetary reflation is following the usual pattern. The surge in narrow money began in spring 2015 and was immediately reflected in a change in trend of house prices. A recovery in profits followed from late 2015. Annual narrow money growth rose to a new high in August, suggesting that annual house price inflation and profits growth are still some way from peaking – second chart.

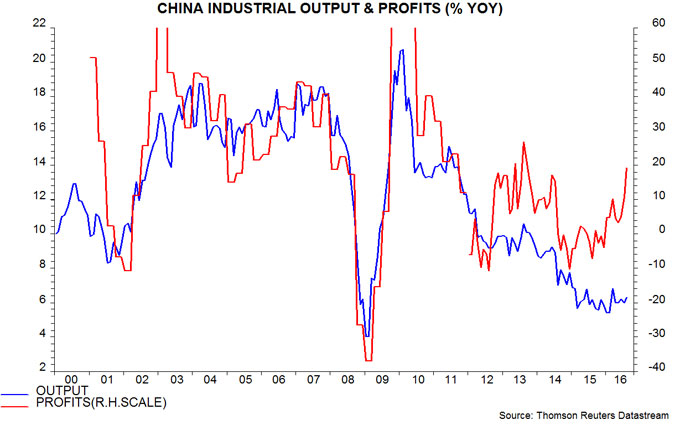

The usual pattern implies that investment and industrial output growth will now strengthen: profits and output cycles have been closely entwined historically – third chart. Stronger industrial activity, in turn, would be expected to feed through to a further recovery in pricing power and faster nominal GDP expansion.

In this scenario, monetary policy would probably shift from its current easing bias towards modest tightening, suggesting a reduction in capital outflows and re-emergence of upward pressure on the exchange rate from the large current account surplus.