Entries from September 18, 2016 - September 24, 2016

UK services data suggesting respectable Q3 GDP rise

The Office for National Statistics will release a July number for the index of services on 30 September. This number will be a key input to the preliminary estimate of GDP in the third quarter, to be released on 27 October. The indications are that services output rose solidly in July, in turn suggesting that the preliminary GDP estimate will show respectable quarterly growth – possibly as high as 0.4%. Such an outcome would add to doubts about the necessity of the MPC’s August easing package and could block the further rate cut apparently desired by a majority of Committee members.

There are two reasons for expecting the July services number to be solid. First, retail services output has a 7.1% weight in the index and is measured by retail sales volume, which rose by 1.9% in July, implying a contribution of 0.1 percentage points.

Secondly, services turnover data for July released earlier this week suggest that output increased in a number of other industries.

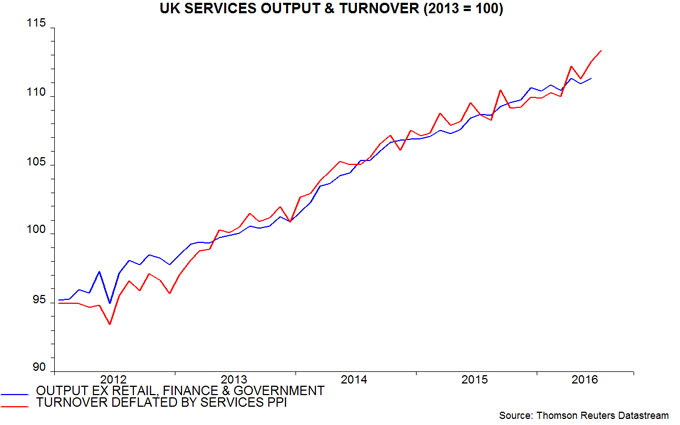

Translating the turnover data into a forecast for output is not straightforward and attempts here to draw inferences in the past have not always been successful. The difficulties include: turnover is measured in current price terms and is not adjusted for seasonal factors or working days; the turnover survey omits some important output components, including financial services, government activities and imputed rent; and the industry shares in the turnover data differ from the weights used in the output index.

The chart compares a subset of the output index accounting for 58% of the total with an estimated series for real turnover adjusted for seasonals / working days and weighting differences. This series has tracked monthly output changes reasonably well and suggests a further solid increase in July.

Based on the above, total services output may have risen by 0.4% in July, assuming no significant weakness in components for which there is little or no information.

Combined with already-released data on industrial and construction output, such an increase would imply that GDP in July was 0.3% above the second-quarter level. The preliminary third-quarter GDP estimate will also take into account August industrial / construction data (to be released on 7 and 14 October respectively) and early results of the August turnover survey, with statistical methods used to estimate September numbers. These methods are likely to extrapolate recent growth, implying the possibility of a 0.4% quarterly GDP increase barring weakness in the August data.

A 0.4% rise would also be consistent with July / August vacancies data – see previous post.

At its July meeting, the MPC judged that the Brexit vote “was likely to depress economic activity in the near term”. The Committee was more explicit in August, expecting “little growth in GDP during the second half”, with the Bank’s staff forecasting that that the preliminary third-quarter estimate would show no change from the second quarter. Better data forced an upgrade in September but the MPC still anticipated “a material slowing of UK GDP growth”, with the staff estimating a preliminary third-quarter increase of only 0.2%.

Third-quarter growth of 0.4%, with the possibility of a future upward revision, would, therefore, raise question marks about the MPC’s pre- and post-Brexit vote analysis and policy strategy. It could be difficult, in these circumstances, for the Committee to follow through on its strong guidance of a further cut in Bank rate to 0.1% (although Governor Carney’s tendency to find alternative rationales for a desired course of action should not be discounted).

BoJ reaction: yield target boosts medium-term inflation risk

The Bank of Japan announced changes to its monetary policy strategy that will have little impact on current monetary conditions but are potentially significant for the medium term. Markets have reacted with relief that the BoJ rejected the option of cutting the policy rate deeper into negative territory, a move that would have raised further doubts about financial-system health.

The two key changes are: first, the abandonment of quantitative goals for JGB purchases and monetary base expansion in favour of a target, currently set at “around zero”, for the 10-year JGB yield; and secondly, a commitment to keep expanding the monetary base until consumer price inflation (as measured by the CPI excluding fresh food) overshoots the 2% target “in a stable manner”.

The shift to a yield level target set at zero will have little impact on current market conditions but suggests that policy will be more inflationary over the medium term. Under the previous strategy of QE targets, a rise in inflation would have been expected to be matched by a firming of JGB yields, keeping real yields broadly stable. The new peg at zero will force real yields lower as inflation picks up – policy, in other words, will become more expansionary as inflation rises towards the target, consistent with the BoJ’s new goal of achieving a sustained overshoot.

A yield level target also implies that the US-Japanese differential will be driven solely by Treasury yields. Stronger US growth and a hawkish Fed, therefore, should put more upward pressure on the US dollar / yen exchange rate than under the previous strategy.

Some commentary may interpret the changes as disappointing and evidence that the BoJ is running out of ammunition. The judgement here is that there was no need for another bazooka shot – strong monetary trends, improving global economic prospects and a tight labour market suggest a pick-up in growth and further progress in reviving inflation. The BoJ’s backpedalling on negative rates and implied commitment to falling real yields are positive developments for the equity market, which will continue to benefit from BoJ buying of ¥6 trillion per year, equivalent to 1.9% of TOPIX market cap.

Will the global economy boom in 2017?

The forecasting approach employed here suggests a significant probability of a global economic boom in 2017. If activity, instead, remains weak, it will indicate that the monetary transmission mechanism has failed and monetary indicators have gone haywire – with extremely bearish implications for asset prices.

There are four key reasons for adopting a boom as a central investment scenario:

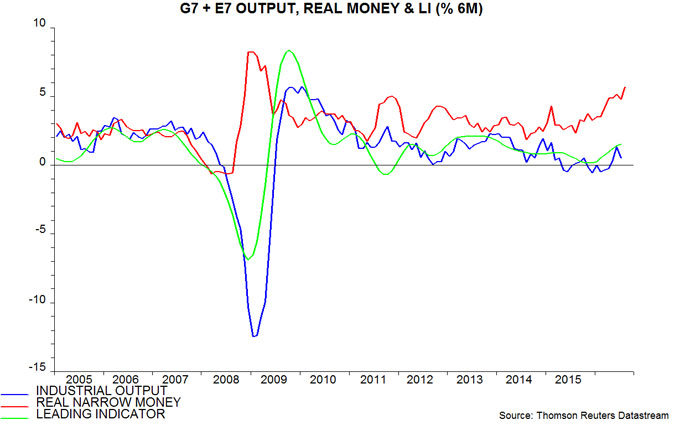

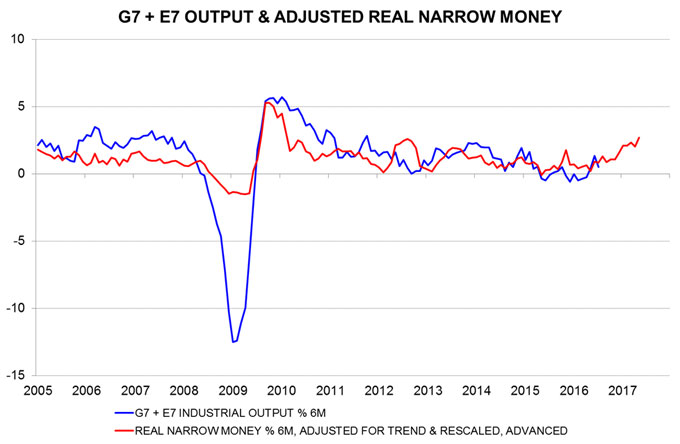

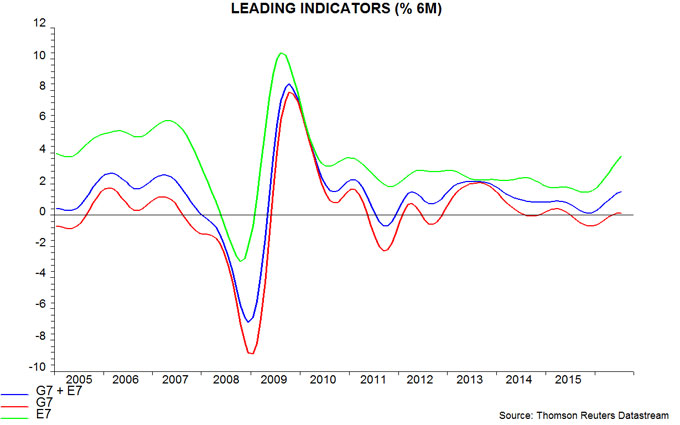

1) Global real narrow money is surging. Six-month growth of real narrow money in the G7 plus emerging E7 economies is estimated to have risen to about 5.5% (11.5% annualised) in August, the fastest since 2009, ahead of a sustained period of solid global expansion – see first chart. Monetary trends are strong across the major economies.

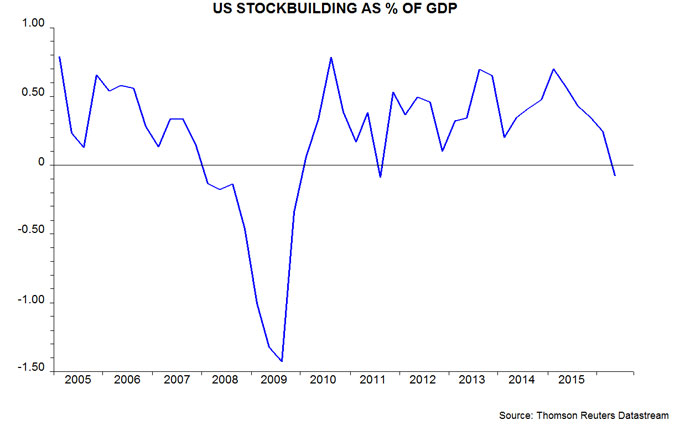

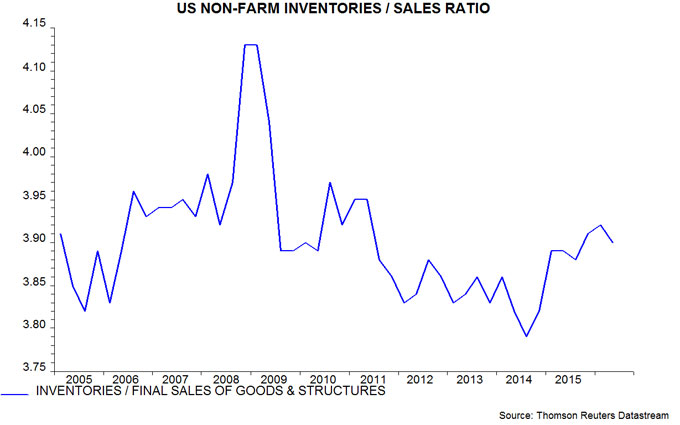

2) The US three- to five-year Kitchin stockbuilding cycle is probably at or near a low. Downswings in this cycle are associated with US / global economic slowdowns (e.g. 2011-12) or recessions if they coincide with weakness in the Juglar business investment and / or Kuznets housing cycles (e.g. 2008-09) – see previous post for more discussion. The change in inventories subtracted 0.8 percentage points from GDP growth in the year to the second quarter, turning negative in that quarter, suggesting that the current downswing is complete – second chart.

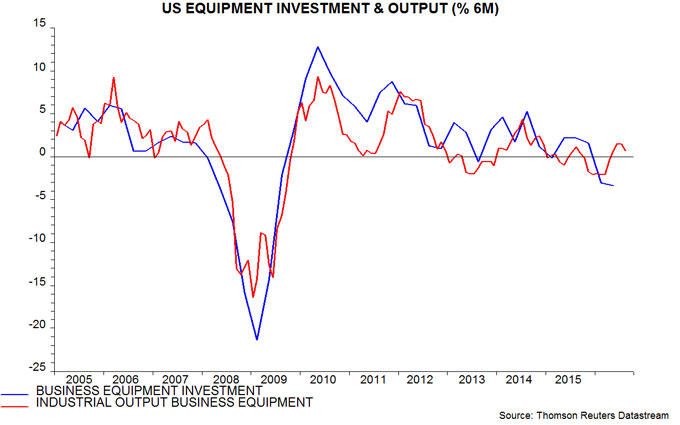

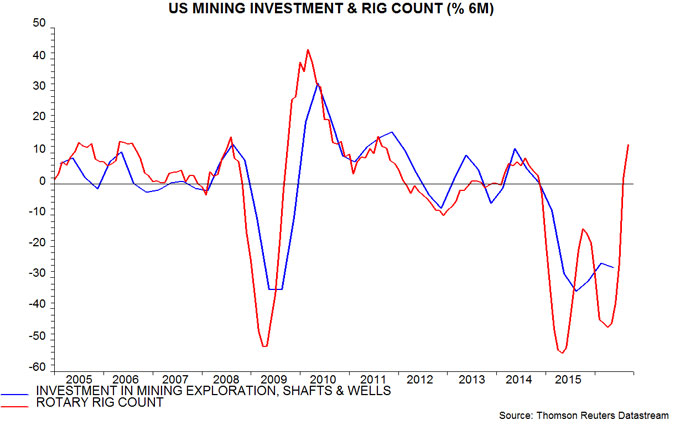

3) The US seven- to 11-year Juglar business investment cycle appears to be entering another expansion phase following a mid-upswing pause partly due to the oil bust. The cycle last bottomed in 2009 and is scheduled to reach another low between 2016 and 2020. A late date is now more likely, with recent data signalling a recovery in equipment and mining investment – third and fourth charts.

4) The OECD’s composite leading indicators are strengthening. Six-month growth in the G7 plus E7 trend-restored indicator calculated here from the OECD data is the strongest since 2014 – first chart.

Why could this forecast be wrong? The following objections to the above points have been raised in discussions:

1) Zero / negative rates have disrupted and may have destroyed the historical relationship between narrow money trends and future activity. Narrow money has been growing solidly for a while without this being reflected in stronger growth. Response: low rates have resulted in a faster fall in the velocity of circulation of narrow money but the directional relationship between changes in real money growth and output growth has remained intact. An adjusted real money growth measure incorporating a faster velocity decline and applying the historical average nine-month lead from money to activity has tracked output growth well and is signalling a strong upswing – fifth chart.

2) The US inventories to sales ratio remains elevated, suggesting that the Kitchin cycle downswing has further to run – sixth chart. Response: the cycle bottoms when the change in stocks has its maximum negative impact on GDP growth. This typically occurs soon after the inventories to sales ratio peaks but while it is still high – the current position. The ratio falls to normal or low levels only well into the upswing.

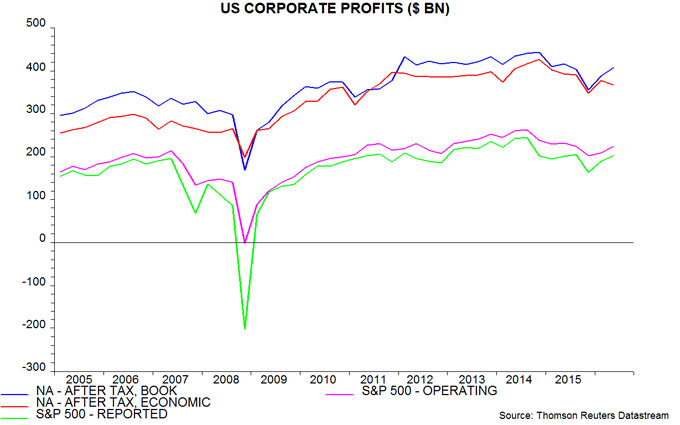

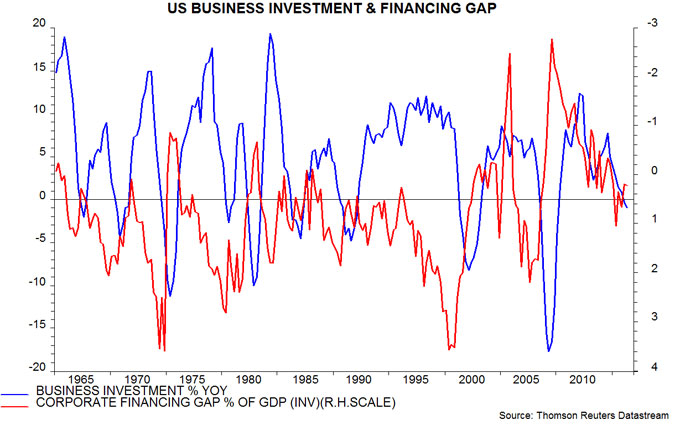

3) US profits remain weak, arguing against a pick-up in business investment. Response: profits fell between summer 2014 and late 2015, with energy extraction accounting for about half of the decline. There has, however, been a partial recovery so far in 2016, despite weak GDP growth – seventh chart. The corporate financing gap (i.e. the difference between capital spending and retained earnings), meanwhile, was a modest 0.2% of GDP in the second quarter, down from 1.0% in the second quarter of 2015; the gap is an inverse long leading indicator of investment – eighth chart. Low borrowing costs are an additional positive – the corporate BAA yield is currently 55 basis points below its five-year average.

4) The pick-up in the G7 plus E7 leading indicator has been driven by the E7 component, with the G7 component still weak – ninth chart. Response: the G7 leading indicator has started to turn up, while G7 real narrow money trends are strongly positive.

A forecast of economic strength will be maintained here but confidence in the scenario would be increased by a fall in the US inventories to sales ratio, a further recovery in US profits and confirmation of an upturn in the G7 leading indicator.