Entries from August 28, 2016 - September 3, 2016

US growth pick-up on track despite data "misses"

Negative data surprises yesterday and today have dealt a superficial blow to the view here that US economic growth is gathering pace. The surprises, however, are judged to be of minor significance and more than outweighed by August monetary data showing a further pick-up in narrow money expansion.

The first surprise was a drop in the Institute for Supply Management (ISM) manufacturing purchasing managers’ index to 49.4 in August from 52.6 in July. The new orders component was particularly weak, falling to 49.1 from 56.7.

The first chart compares the ISM new orders index with an average of current and future order balances in five regional Fed manufacturing surveys (New York, Philadelphia, Richmond, Kansas, Dallas). The ISM series had been stronger (relative to history) than the Fed average over the prior three months and appears to have overcorrected in August. The Fed series remained in expansionary territory last month and well above a low reached in May / June.

The second chart separates the Fed average into current and future components. The current component mirrored the weakness of the ISM new orders index in August but the future component rose to a 20-month high.

ISM weakness, therefore, seems partly to reflect statistical noise and will probably prove temporary.

The second negative surprise was today’s August employment report, showing smaller-than-expected rises in non-farm payrolls and average earnings, and a fall in average weekly hours. The payrolls miss, however, was minor and follows blockbuster gains in June and July: the three-month moving average rose to 232,000, the strongest since January – third chart.

Annual growth of hourly earnings of private production and non-supervisory workers edged down from 2.5% to 2.6% but the trend remains up, consistent with a high job openings rate – fourth chart. Earnings growth stood at 2.0% when the Fed hiked rates in December.

The above indicators are coincident (at best) measures of the economy. Narrow money trends are of much greater significance for judging prospects: changes in real (i.e. inflation-adjusted) narrow money growth have consistently led swings in GDP expansion in recent years. Weekly data through 22 August indicate that real money growth rose further last month to its highest level since February 2015 – fifth chart.

The view here remains that the Fed will raise rates before year-end, with a move this month still possible. The narrow money backdrop, moreover, is much stronger now than in December 2015, suggesting that a further increase will occur in early 2017 as economic growth exceeds Fed and consensus expectations.

UK currency in circulation still growing strongly

The buoyancy of UK retail spending in the wake of the Brexit vote had been signalled by strong July growth of notes and coin in circulation. Weekly Bank of England data on the note issue suggest that the stock of currency rose solidly again in August, hinting that spending has remained firm.

Annual growth of notes and coin has been trending higher since late 2015, reaching 8.2% in July, the fastest since 2009. Annual growth in the note issue, meanwhile, rose from 8.6% in July to 8.8% in August, according to the weekly Bank of England data – see chart. This suggests that the monthly rise in currency in circulation in August exceeded a 0.6% increase in August 2015. (Notes account for more than 90% of the currency stock.)

In addition to spending resilience, currency demand may have been boosted by further cuts in instant-access deposit rates and fears that banks will start to charge for operating current accounts. As previously discussed, data in the Bank’s Annual Report show that the stock of £50 notes has been growing particularly strongly, possibly indicating rapid expansion of illegal economic activity and / or “hoarding” of such notes.

UK CBI business surveys suggesting slowdown not recession

The CBI’s expected growth indicator – a weighted average of business expectations from its manufacturing, distribution and services surveys – is likely to have recouped part of its July loss in August, based on already-released data. The current level of the indicator is consistent with weak economic expansion.

The expected growth indicator slumped from +16% in June to -3% in July but even the latter was above a level suggesting economic contraction, based on historical evidence. The indicator is estimated to have recovered to about +4% in August, reflecting gains in all three component surveys, with a particularly large rebound in retail / wholesale trade expectations – see chart*.

The historical correlation of the CBI indicator with quarterly GDP / gross value added (GVA) changes is similar to that of the more widely-followed composite PMI output index, the July level of which was consistent with quarterly contraction of 0.4%, according to the index compilers. The CBI indicator suggests that the PMI will recover in August but it may remain below the “breakeven” 50 level, partly because its coverage excludes distribution.

*The CBI indicator values in the chart have been seasonally adjusted. Seasonal influences appear to have contributed to the large fall in the indicator in July.

UK money data reassuring, no case for rate cut

UK monetary data for July showed no negative impact from the Brexit vote. Narrow and broad money rose solidly on the month, while bank lending continued to expand. The suggestion is that the economy remains on a growth path with little risk of a recession. There is no monetary case for a further cut in Bank rate.

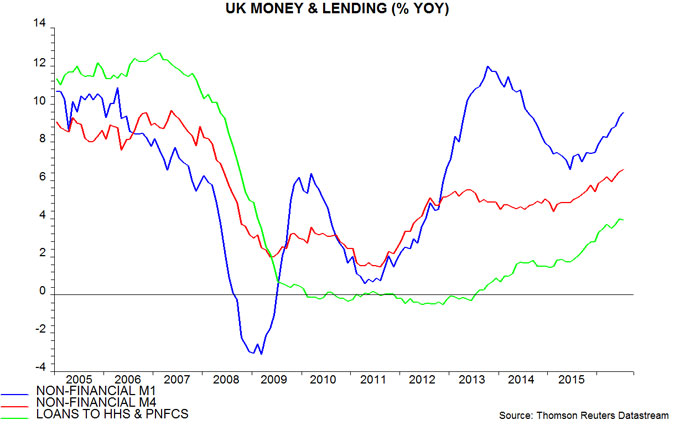

The favoured narrow and broad money measures here are “non-financial” M1 and M4, comprising money holdings of households and private non-financial corporations (PNFCs). These measures grew by 1.0% and 0.6% respectively in July, while bank lending to households and PNFCs gained 0.2%. Non-financial M1 rose by 9.6% in the latest 12 months, with non-financial M4 up by 6.6% – see first chart.

An oncoming recession would be expected to be signalled by a contraction of narrow money holdings, associated with households and firms revising down spending plans and / or receiving less income than expected. Both household and PNFC M1 rose solidly in July, by 1.0% and 1.1% respectively.

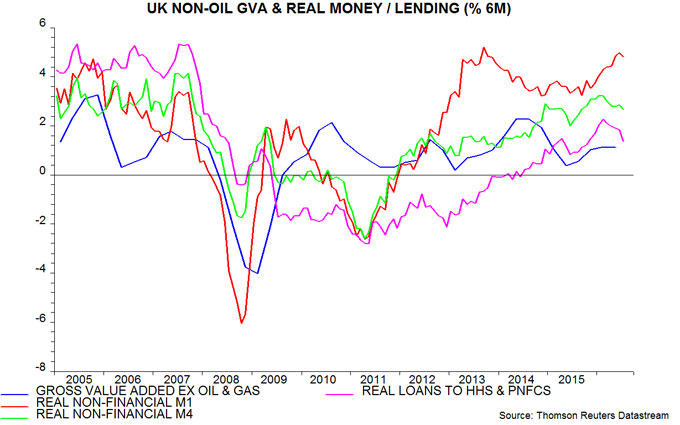

The forecasting approach here focuses on the six-month change in real (i.e. inflation-adjusted) non-financial M1. A rise in this measure in late 2015 correctly signalled that GDP / gross value added (GVA) momentum would pick up into mid-2016. Real non-financial M1 growth may have peaked in June but remained strong in July – second chart.

Six-month growth of real non-financial M4, meanwhile, has fallen since February 2016 but remains above its average in recent years.

Taken together, these developments suggest that GDP / GVA expansion will moderate from its first-half pace while remaining respectable.

Economic behaviour, of course, has only started to adjust to Brexit uncertainties and monetary trends could weaken significantly over coming months. For the moment, however, recession risk appears low: the six-month change in real non-financial M1 has turned negative before all previous recessions over the past 60 years.

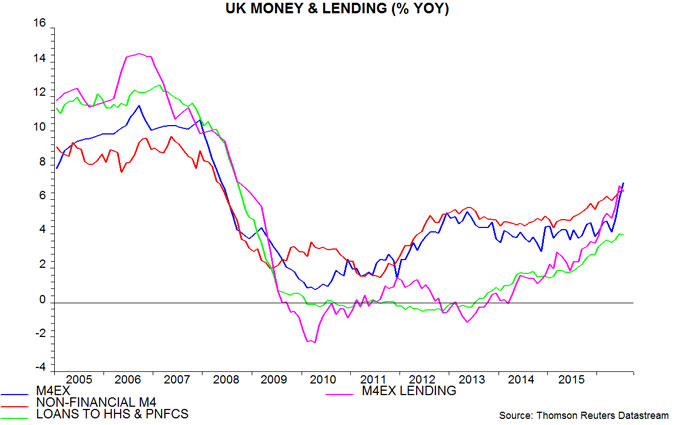

Annual growth of the Bank of England’s preferred broad money measure, M4ex, surged to 6.9% in July, above the 6.6% expansion of non-financial M4 – third chart. M4ex includes financial-sector money holdings, which have picked up strongly, rising by an annual 9.3% in July. This pick-up follows an extremely rapid increase in bank lending to the financial sector, annual growth of which peaked at 36.1% in June. The strength of both lending and deposits has been concentrated in “fund management activities” and may reflect the implementation of liability-driven investment strategies on behalf of pension funds. These financial-sector developments, in any case, are probably of little significance for future spending on goods and services.