Entries from June 26, 2016 - July 2, 2016

UK economy at cruising speed entering Brexit storm

Data this week confirm that the UK economy was growing solidly before the EU referendum, in line with the positive assessment in previous posts here but contrary to consensus gloom.

Revised figures show that GDP grew by 0.45% in the first quarter, up from a previous estimate of 0.36%. The consensus had expected a sharp slowdown, or even stagnation, in the second quarter. Output of the key services sector, however, increased significantly in April (as had been suggested by turnover data), to stand 0.5% above its first-quarter average.

With previously-released data showing large gains in industrial and construction output, April GDP is estimated to have grown by 0.6% from its first-quarter level.

The April numbers were probably flattered by the early timing of Easter, suggesting a relapse in May / June. On current evidence, however, the first estimate of second-quarter GDP growth to be released on 27 July is unlikely to be less than 0.4%.

The Markit manufacturing purchasing managers’ survey for June, meanwhile, was upbeat, with the forward-looking new orders component at its strongest level since October.

UK corporate money signalling rising caution pre EU referendum

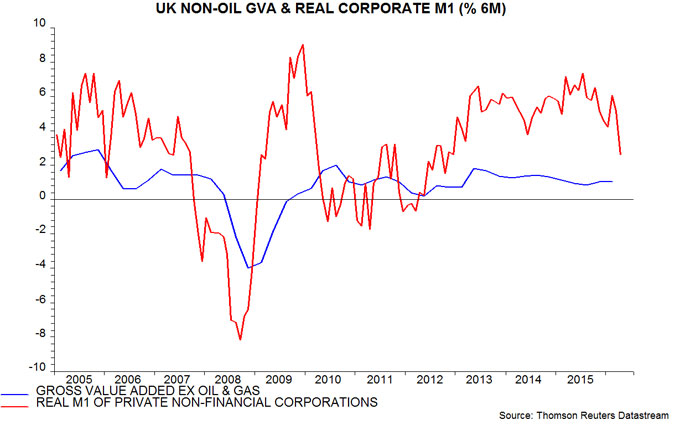

UK corporate money trends have weakened since late 2015, consistent with companies putting expansion plans on hold pending the result of last week's referendum.

Corporate money (i.e. held by private non-financial corporations, or PNFCs) will be a key indicator for assessing whether the referendum shock will push the economy into a recession. Corporate money leads business investment and overall activity, probably because companies adjust their liquidity position to reflect their spending / hiring plans. Real (i.e. inflation-adjusted) corporate money contracted before the 1979-81, 1990-91 and 2008-09 recessions, as well as the 2011-12 “double-dip” slowdown.

The first chart shows six-month growth rates of real corporate narrow money M1 and broad money M4, along with the two-quarter change in GDP*. Both measures were strong last autumn, consistent with recent “hard” data suggesting solid GDP expansion during the first half of 2016, allowing for a typical nine-month lead from money to activity.

The six-month change in real corporate M1, however, has fallen significantly since February, while that of real M4 has turned slightly negative. M1 is preferred here for forecasting purposes: it is closer to the concept of "transactions money" and appears to work better empirically. An example of the superior performance of real M1 was its mild contraction before the 2011-12 slowdown; a much larger fall in real M4 seemed to predict a recession. The recent decline in real M1 growth suggests that companies were planning for slower expansion but not a fall in activity before the referendum.

Weakening corporate money growth contrasts with strengthening household trends. Six-month growth of household real M1 and M4 rose to 15- and nine-year highs respectively in May, suggesting solid near-term consumer spending prospects – see second chart. Household income and money growth, however, may slow as companies curb expansion plans and hiring. Corporate money often leads household trends: corporate real M1 contracted before household real M1 ahead of the 2008-09 recession.

The base-case assumption here is that increased uncertainty due to the referendum shock will subtract 1.0-1.5 percentage points from GDP growth over the next 12 months, implying a significant slowdown rather than a recession. This view will be revised negatively if corporate real M1 contracts over coming months.

*M1 = notes / coin + sterling sight deposits. M4 = M1 + sterling time deposits, short-term bank bonds and repos.

UK corporate money trends key for assessing recession risk

The EU referendum result will have a negative impact on UK economic prospects but there is little basis, at present, for assessing the magnitude of the effect.

The negative impact will occur through two key channels: an uncertainty effect on business investment and hiring, and a possible tightening of financial conditions.

The uncertainty effect alone is probably insufficient to trigger a recession. GDP was judged here to be growing at a rate of about 2.25% per annum before the shock, based on monetary trends and the most recent “hard” data. A 10% cut in private investment over the next 12 months relative to previous plans – possibly an aggressive assumption – would subtract 1.4 percentage points from GDP growth, i.e. insufficient to push the economy into contraction.

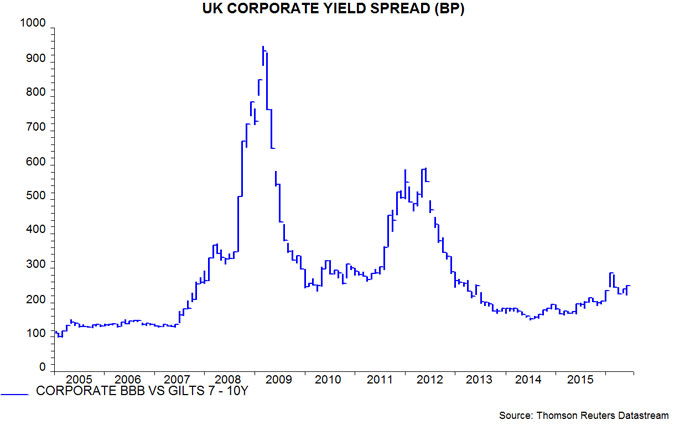

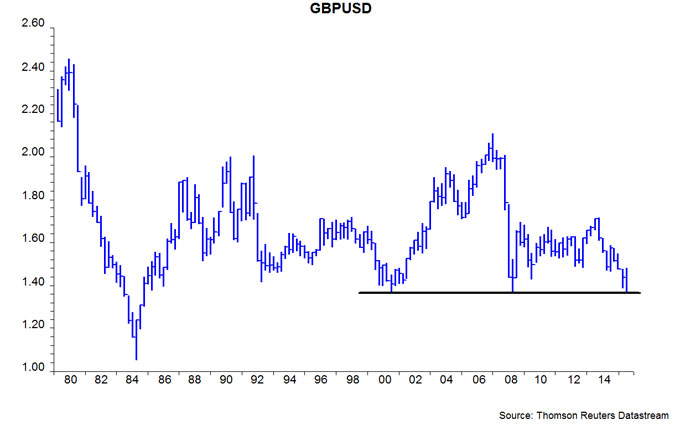

Financial conditions could tighten significantly but have yet to do so. Corporate bond spreads remain contained – see first chart – and equities have yet to breach their February low in sterling terms. The Bank of England, moreover, is likely to deliver a precautionary easing move by August. The exchange rate has so far taken the strain of the referendum result, with the sterling-US dollar rate falling to the mid-1.30s for the third time in 15 years – second chart.

Assuming no significant change in financial conditions, a reasonable base case is that GDP growth over the next 12 months will be 1.0-1.5 percentage points lower than otherwise. So, for example, 2017 growth could be 1% instead of 2.25%.

The approach here will be to adjust this base case forecast depending on corporate money trends, which should give early warning of any major retrenchment. Corporate real narrow money M1 has contracted before recessions historically, also weakening before the 2011-12 slowdown – third chart. Six-month growth fell in April, possibly reflecting pre-referendum caution; May data will be released on Wednesday.

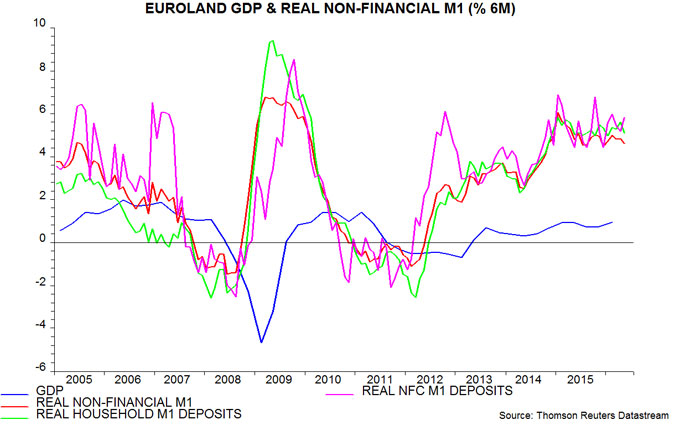

The direct spillover effect of UK economic weakness on the rest of the European Union will be minor: exports to the UK account for only 3% of rest of EU GDP. The much bigger risk, again, is financial contagion. Monetary trends, as in the UK, were giving a positive signal for economic prospects before the shock: real non-financial M1 growth, and its corporate component, remained strong in May – fourth chart.

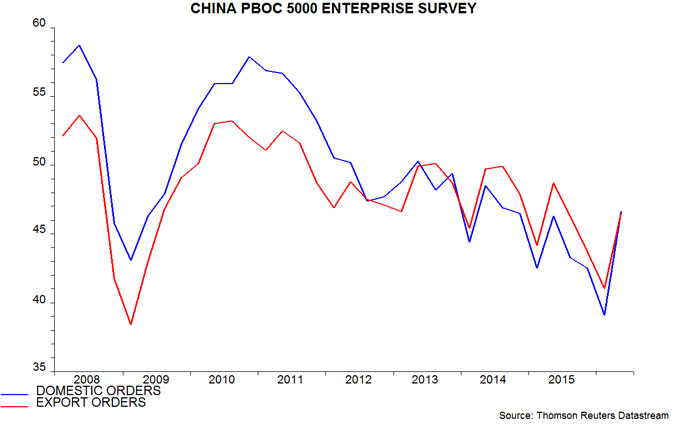

Recent data are consistent with the view here that US / Chinese economic growth is picking up at mid-year; the latest quarterly PBoC survey of enterprises, for example, reports an improved assessment of orders – fifth chart. The direct global impact of weaker UK / European prospects will be small and offset by looser central bank policies. A constructive assessment will be maintained barring a reversal of recent global narrow money strength.