A "monetarist" perspective on current equity markets

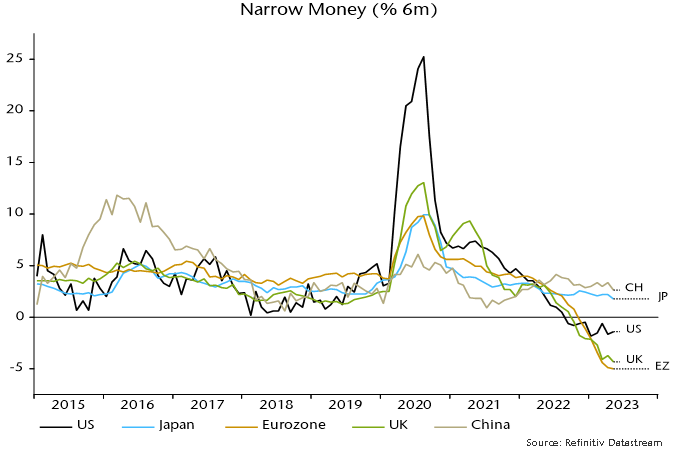

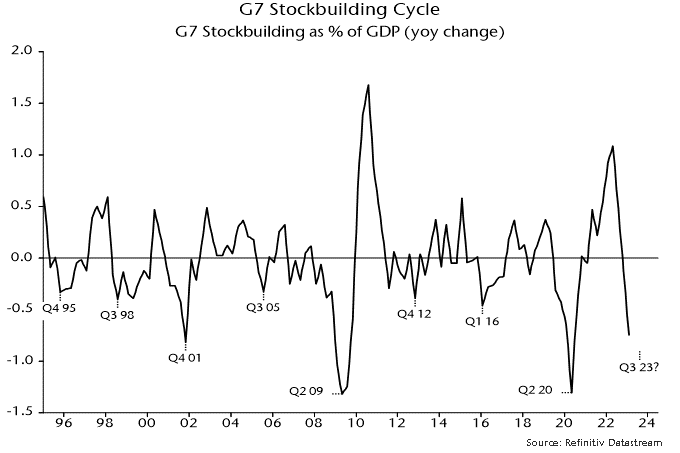

Monetary and cycle aspects of the forecasting approach used here are currently in tension. Global real narrow money trends suggest a renewed weakening of economic momentum into late 2023. Cyclical forces, however, are scheduled to become more supportive from early 2024 as the stockbuilding cycle bottoms out and moves into a recovery phase.

The two messages can be reconciled if real money momentum recovers over the remainder of 2023, confirming an improving outlook for 2024. Momentum is expected to be lifted by a further slowdown in inflation but a sufficient recovery is unlikely without a policy reversal by major central banks. Current signals are that such a reversal will require a dramatic deterioration in economic data and / or major market weakness.

Economic news has been confusing, allowing optimists and pessimists to claim support for their assessments. Weakness appears the correct interpretation based on national accounts data. An average of the expenditure and income measures of US GDP rose at an annualised rate of only 0.3% in the five quarters to Q1 2023. The monthly measure of UK gross value added has flatlined since last summer while Eurozone GDP slipped into contraction in Q4 / Q1.

Claims of economic resilience or even strength focus on solid employment growth and tight labour markets. Weak GDP expansion has been unusually jobs-rich because of a rebound in the share of lower-productivity services activities. With the goods / services split normalising, this composition boost is probably ending.

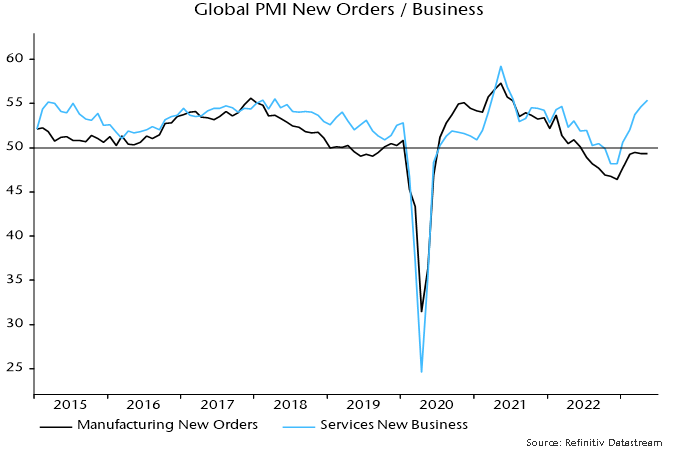

GDP / employment divergence has been echoed in PMIs, with manufacturing weakness balanced by services strength. Again, the assumption here is that services exceptionalism is temporary, reflecting a later release of pent-up demand, suggesting focusing on manufacturing as a better guide to trend.

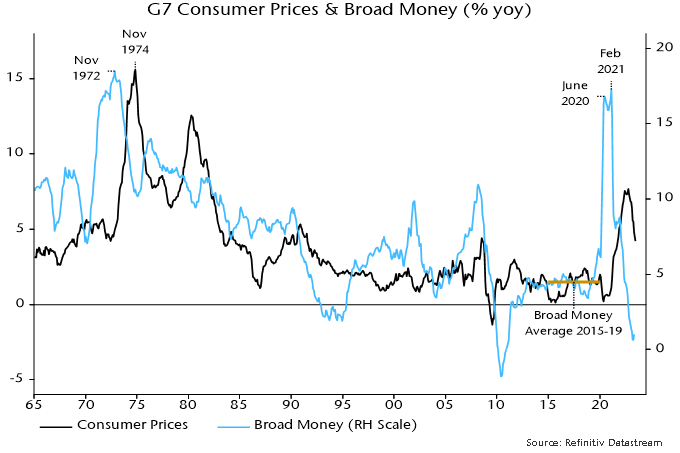

The global manufacturing PMI new orders index reached a 31-month low in December 2022, recovering modestly into the spring before falling back sharply in June. A revival and relapse had been signalled by six-month real narrow money momentum, which recovered during H2 2022 but eased again in early 2023. The recent slide extended into May, suggesting further PMI weakness into late 2023 – see chart 1.

Chart 1

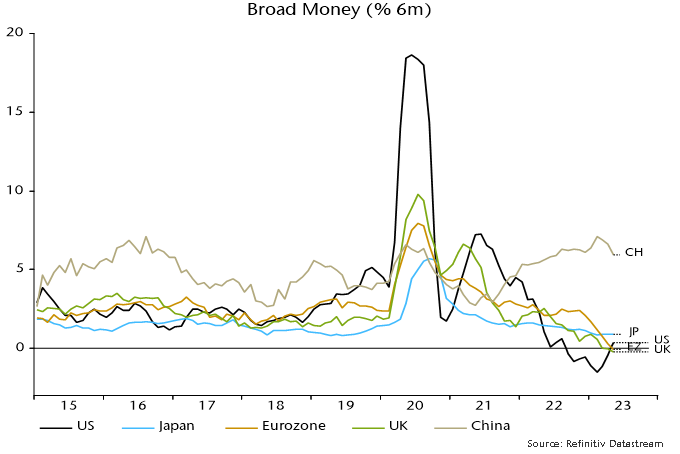

Monetary alarm bells are ringing loudest in Europe. Six-month rates of contraction of Eurozone and UK nominal narrow money quickened further in May, contrasting with less negative and stabilising US momentum – chart 2. Six-month changes in broad money have also now crossed below zero and the corresponding US change – chart 3. Trends in Sweden and Switzerland are even weaker.

Chart 2

Chart 3

China and India remain positive monetary outliers but narrow money momentum is modest by historical standards and has subsided recently. Relative to monetary trends, the consensus view on China looked overoptimistic at the start of 2023 and appears excessively gloomy now, although further policy easing is warranted to cushion the economy against likely export weakness despite a super-competitive exchange rate.

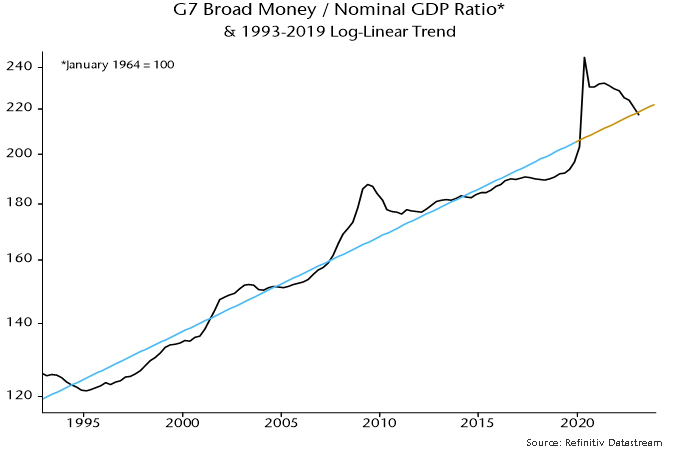

To the extent that the global economy has proved more resilient than expected, one explanation is that the impact of monetary weakness has been delayed by an overhang of “excess” money balances / savings resulting from 2020-21 stimulus. The ratio of G7 broad money to nominal GDP crossed back below its pre-pandemic trend in Q1 2023, suggesting that stock and flow arguments for pessimism are becoming aligned – chart 4.

Chart 4

Cycle analysis is used here to provide longer-term context and a cross-check of monetary signals. Economic fluctuations reflect the interaction of three investment cycles: a shorter stockbuilding cycle typically of about 3 1/3 years in duration; an intermediate business investment cycle of 7-11 years; and a longer housing cycle averaging about 18 years.

The business investment and housing cycles last reached lows in 2020 and 2009 respectively. If current cycles are of normal length, the next lows could occur in the late 2020s. Downswings into lows typically play out over 1-3 years so are unlikely to begin before 2025. This suggests that recent softness in housing and business investment represents a temporary correction within ongoing upswings. Current cyclical weakness, on this interpretation, reflects a downswing in the shorter-term stockbuilding cycle, which last bottomed in Q2 2020 and recently entered the time band for another low.

Stockbuilding cycle downswings in isolation are usually associated with global economic slowdowns or at worst recessions that are modest and / or geographically contained. Examples of the latter include the 1970 US recession and the 2011-12 Eurozone downturn. Against a backdrop of monetary weakness and unusually rapid policy tightening, the expectation here has been the current downswing would be more severe and global than the norm.

The cycle analysis suggests, however, that the window for severe economic weakness will begin to close from late 2023. Recent stockbuilding data indicate that the cycle downswing is already well-advanced, consistent with a low being reached before year-end – chart 5. A stockbuilding recovery could combine with continuing upswings in business and housing investment to drive global economic reacceleration in 2024-25. As noted, however, such a scenario requires confirmation from an early recovery in real money momentum, in turn probably dependent on H2 policy reversals.

Chart 5

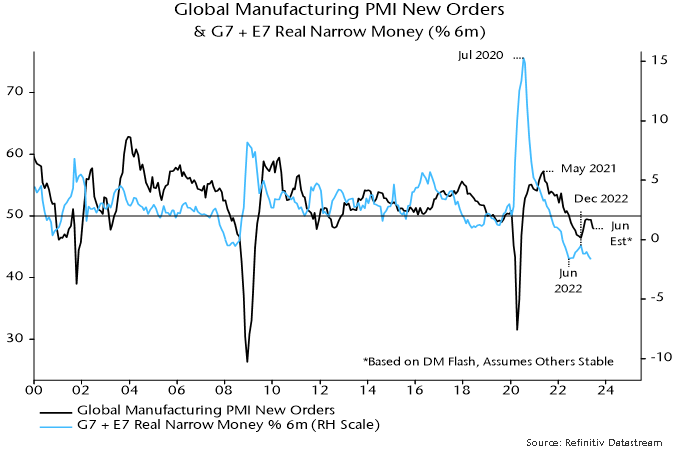

The “monetarist” forecast was that G7 headline CPI inflation would fall rapidly from early 2023, mirroring a large and sustained decline in annual broad money growth from a February 2021 peak. This scenario is playing out: a GDP-weighted average of G7 national headline rates dropped from 6.8% in January to 4.8% in May, with a further decline to 4.2% projected for June – chart 6.

Chart 6

Broad money growth returned to its pre-pandemic average in mid-2022 so – allowing for a standard two-year lead – inflation rates may be back at pre-pandemic (i.e. target-consistent) levels in mid-2024. Recent further monetary deceleration suggests significant risk of an undershoot in late 2024 / 25. The cyclical counterargument is that stockbuilding cycle upswings are usually associated with rising commodity prices, which may support headline rates moving through 2024.

A tendency of policy-makers and commentators to downplay headline progress and focus on stickier core readings is the mirror-image of 2021 claims that a headline surge was “transitory”. Disinflation is following the usual sequence from commodities to goods to lagging services / wages. Recent US / Eurozone data confirm a downshift in short-term core momentum, e.g. US “super-core” consumption prices – ex. food, energy, housing and used cars – rose by an annualised 3.1% between February and May, the smallest three-month gain since December 2020.

The two global “excess” money indicators calculated here – the gap between six-month real narrow money and industrial output momentum, and the deviation of 12-month real narrow money momentum from a slow moving average – have been negative in most months since the start of 2022, suggesting an unfavourable backdrop for equity markets. Despite a strong H1 rally, the MSCI World index was 8.2% below its closing 2021 level at end-June. Cyclical sectors (including tech) lagged defensive sectors (including energy) over this period.

An earlier hope that the first measure – the real money / output momentum gap – would turn positive during H1 was dashed by a combination of renewed monetary weakness and a production boost from an easing of supply constraints. With June global manufacturing PMI results signalling output contraction, a cross-over remains possible soon. The second measure – the deviation of real money momentum from a moving average – is further from a switch.

Historically, equity markets outperformed cash on average only when both measures were positive – still a distant prospect. Both the current negative / negative and possible positive / negative configurations were associated with non-energy defensive sectors outperforming non-tech cyclical sectors.

UK recession gauge in red zone before Q2 rate hikes

A recession likelihood gauge placing weight on monetary variables indicates a high probability of a contraction in UK GDP / gross value added (GVA) over the remainder of 2023.

The indicator, regularly referenced in posts here, is based on a model that generates projections for the four-quarter change in GVA three quarters in advance using current and lagged values of a range of monetary and financial inputs.

Using data up to June 2022, the model assigned a 70% probability to the four-quarter change in GVA being negative in Q1 2023. The current ONS estimate of this change is +0.2%.

The probability reading rises to 96% incorporating data through March 2023, i.e. there is a 96% likelihood of the four-quarter change in GVA in Q4 2023 being negative, according to the model.

The statistical analysis underlying the model indicates that GDP prospects are significantly influenced by movements in real narrow money (non-financial M1) and real corporate broad money (M4). Six-month rates of change of these measures have moved deeper into negative territory since mid-2022.

The model’s increased pessimism also reflects a deepening inversion of the yield curve and falling real house prices. Other inputs include credit spreads and local share prices, which have yet to display recession-scale weakness.

PMIs weaken on schedule; earnings next?

DM flash results released last week suggest that the global manufacturing PMI new orders index fell sharply in June, having moved sideways in April and May following a Q1 recovery – see chart 1.

Chart 1

The relapse is consistent with a decline in global six-month real narrow money momentum from a local peak in December 2022. A recovery in real money momentum during H2 2022 had presaged the Q1 PMI revival.

Real narrow money momentum is estimated to have fallen again in May, based on partial data, suggesting further PMI weakness into late 2023.

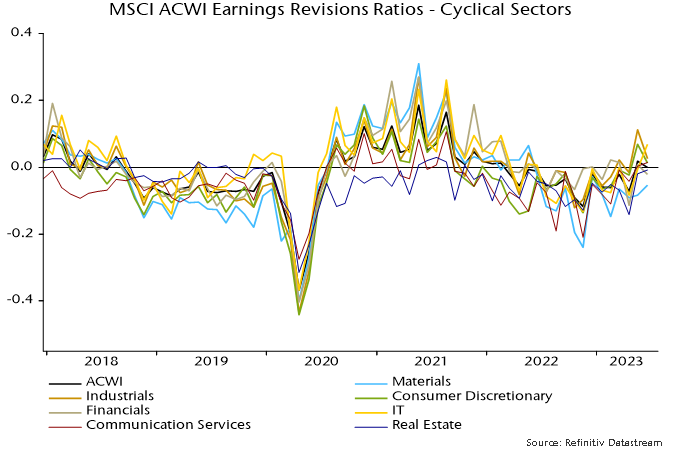

The global earnings revisions ratio has been contemporaneously correlated with manufacturing PMI new orders historically but remained at an above-average level in June, widening a recent divergence – chart 2.

Chart 2

Based on monetary trends, a reconvergence is more likely to occur via weaker earnings revisions than a PMI rebound.

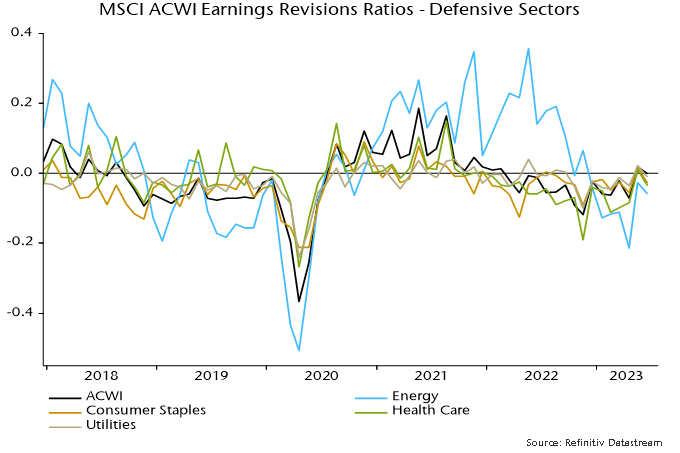

Charts 3 and 4 show that revisions resilience has been driven by cyclical sectors – in particular, IT, industrials and consumer discretionary. Notable weakness has been confined to the materials sector. Cyclical sectors may be at greater risk of downgrades if the global revisions ratio heads south.

Defensive sector revisions have underperformed recently but are likely to be less sensitive to economic weakness.

Chart 3

Chart 4

The positive divergence of earnings revisions from the PMI may reflect firms’ ability to push through price increases to compensate for slower volumes. The deviation of the global revisions ratio (rescaled) from manufacturing PMI new orders – i.e. the gap between the blue and black lines in chart 2 – has displayed a weak positive correlation with the PMI output price index historically (contemporaneous correlation coefficient = +0.41).

Any earnings support from pricing gains is now going into reverse: the output price index has crashed from an April 2022 peak of 63.8 to 49.8 in May, with DM flash results suggesting a further fall last month.

EM leading global inflation decline

Why believe the “monetarist” forecast that recent G7 monetary weakness will feed through to low inflation in 2024-25?

Monetary trends correctly warned of a coming inflationary upsurge in 2020 when most economists were emphasising deflation risk.

The forecast of rapid disinflation is on track in terms of the usual sequencing, with commodity prices down heavily, producer prices slowing sharply and services / wage pressures showing signs of cooling.

A further compelling consideration is that the monetary disinflation expected in G7 economies has already played out in emerging markets.

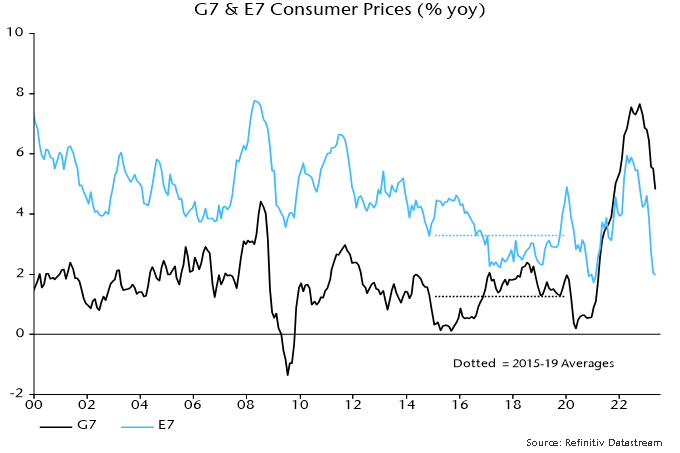

A GDP-weighted average of CPI inflation rates in the “E7” large emerging economies* crossed below its pre-pandemic (i.e. 2015-19) average in March, falling further into May – see chart 1.

Chart 1

The E7 average is dominated by China but inflation rates are also below or close to pre-pandemic levels in Brazil, India and Russia.

Inflation rose by much less in the E7 than the G7 in 2021-22, opening up an unprecedented negative deviation that has persisted.

The recent plunge in the E7 measure reflects a significant core slowdown as well as lower food / energy inflation.

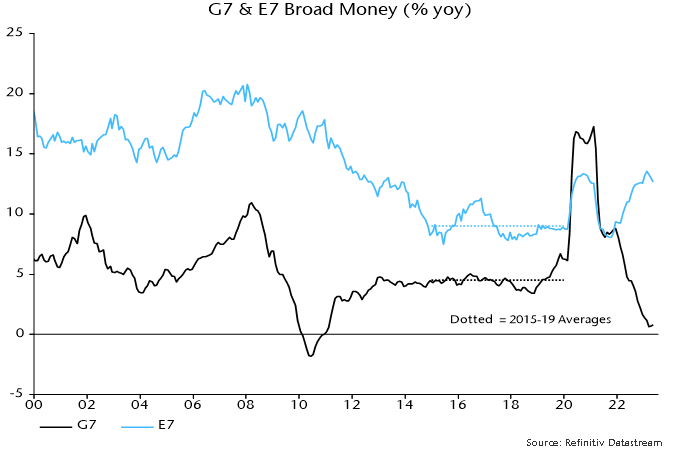

The divergent G7 / E7 experiences are explained by monetary trends. Annual broad money growth rose by much less in the E7 than the G7 in 2020 and returned to its pre-pandemic average much sooner – chart 2.

Chart 2

E7 broad money growth crossed below the pre-pandemic average in May 2021. CPI inflation, as noted, followed in March 2023, i.e. consistent with the monetarist rule of thumb of a roughly two-year lead from money to prices.

G7 broad money growth crossed below its pre-pandemic average in August 2022 and has yet to bottom, suggesting a return of inflation to average in summer 2024 and a subsequent undershoot.

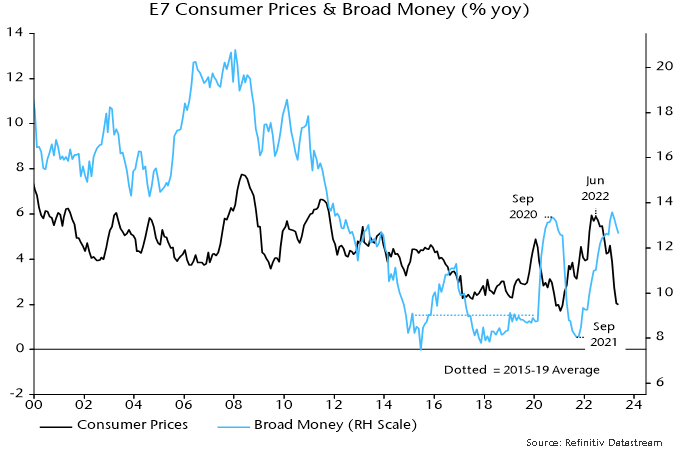

E7 disinflation, however, may be close to an end. Annual broad money growth has recovered strongly from a low in September 2021, signalling a likely inflation rebound during 2024 – chart 3. Broad money acceleration has been driven by China, Russia and Brazil.

Chart 3

E7 annual broad money growth is around the middle of its longer-term historical range and has eased since February. Chinese numbers may have been temporarily inflated by a shift in banks’ funding mix in favour of deposits.

The expected rise in E7 inflation may not extend far but restoration of a positive E7 / G7 differential is likely in 2024.

*E7 defined here as BRIC + Korea, Mexico, Taiwan.

Fed forecasts still suggesting H2 policy shift

The FOMC’s updated economic forecast for the remainder of 2023 is inconsistent with Committee members’ median expectation of a further 50 bp rise in official rates during H2, according to a model based on the Fed’s past behaviour. Policy is more likely to be eased than tightened if the forecast plays out.

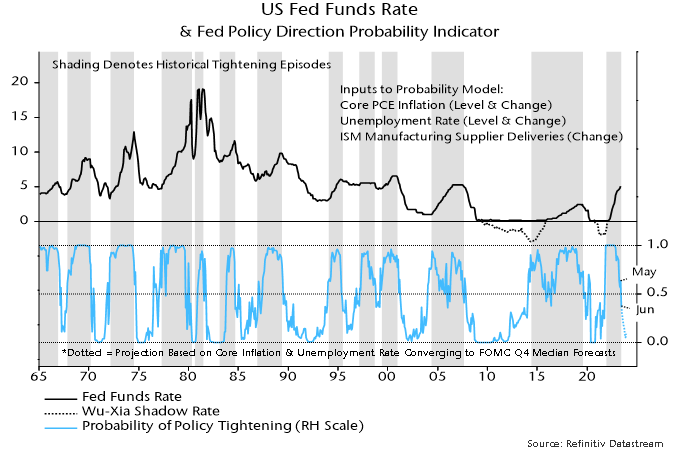

The model estimates the probability of the Fed tightening or easing each month from current and lagged values of core PCE inflation, the unemployment rate and the ISM supplier deliveries index, a measure of production bottlenecks. It provides a simple but satisfactory explanation of the Fed’s historical decision-making, i.e. the probability estimate was above 50% in most tightening months and below 50% in most easing months – see chart.

The probability of the Fed tightening at yesterday’s meeting had been estimated by the model at 36%, the first sub-50% reading since September 2021. (The FOMC started to taper QE at the following meeting in November.)

The FOMC’s median forecast for core PCE inflation in Q4 was revised up to 3.9% from 3.6% previously (currently 4.7%). The unemployment rate forecast was lowered to 4.1% from 4.5% (currently 3.7%).

The model projections shown in the chart assume that core PCE inflation and the unemployment rate converge smoothly to the Q4 forecasts, while the ISM supplier deliveries index remains at its current level. Despite the revisions, the probability estimate still falls to below 10% in Q4, consistent with the Fed beginning to ease by then.

The projections highlight the Fed’s historical sensitivity to the rates of change of core inflation and unemployment as well as their levels. It would be unusual for policy-makers to continue to tighten when inflation and unemployment are trending in the “right” directions, especially given the magnitude of the increase in rates to date.

One difference from the past is that Fed now forecasts its own actions. Has yesterday’s guidance that rates have yet to peak boxed policy-makers into at least one further rise? This may mean that the model’s probability estimate for July – currently 29% – is too low. Still, next month’s decision will hinge on data, with inertia plausible barring stronger-than-expected news.

Is services resilience about to crumble?

Global growth optimists expect continued solid services sector expansion to offset manufacturing weakness. PMI results for May appear, on first inspection, to support this view: services activity and new business indices rose further to 18- and 22-month highs respectively even as manufacturing new orders remained stalled below 50 – see chart 1.

Chart 1

There are, however, several reasons for discounting the strong headline services readings.

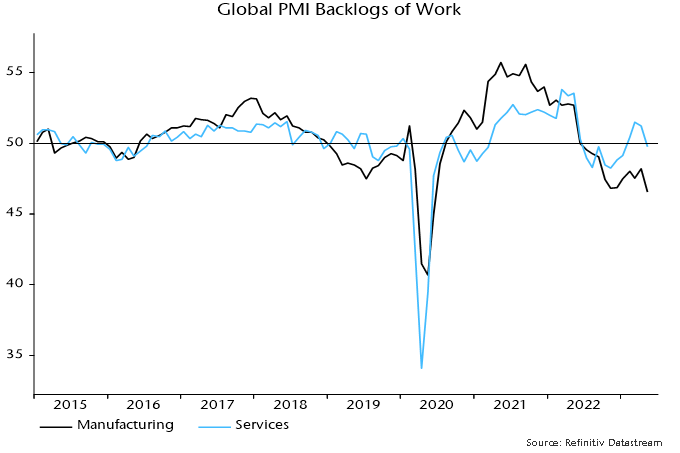

First, backlogs of services work fell sharply to a four-month low despite stronger new business – chart 2. This suggests that current output is running ahead of incoming demand, in turn implying a future adjustment lower unless demand picks up further.

Chart 2

Manufacturing backlogs also fell sharply last month, breaking below their November 2022 low.

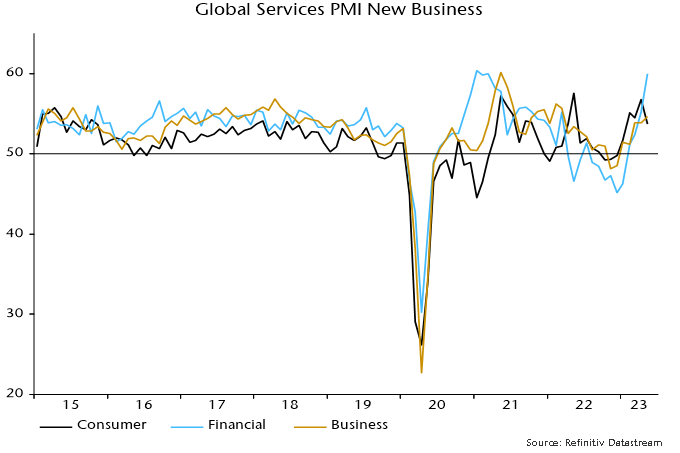

Secondly, the sectoral breakdown of the activity and new business indices shows that May rises were driven by a surge in financial services – chart 3. Consumer services indices eased on the month. Financial services strength is difficult to understand given monetary stagnation, slowing bank lending and flat trading volumes, so may prove short-lived.

Chart 3

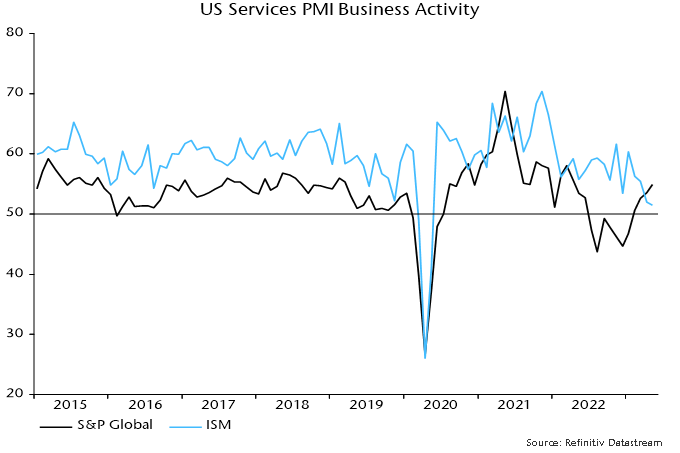

Thirdly, the high May readings of the global activity and new business indices reflect strong contributions from the US and Chinese components but national services surveys are significantly weaker.

The US ISM services activity index fell to a three-year low in May even as the S&P Global equivalent series reached a 13-month high – chart 4.

Chart 4

The Chinese NBS non-manufacturing new orders index moved below 50 in April and fell further in May, in puzzling contrast to the S&P Global / Caixin services new business index, which reached its second-highest level since November 2020.

The global manufacturing new orders and services new business indices have been strongly correlated historically but statistical tests indicate a tendency for manufacturing to lead services rather than vice versa*. With global monetary trends continuing to give a negative economic signal, the current unusually wide gap is more likely to be closed by services weakness than a manufacturing revival.

*In regressions using monthly data with three lags, lagged manufacturing new orders terms are significant in the regression for services new business, but lagged services new business terms are insignificant in the regression for manufacturing new orders.