UK services data suggesting respectable Q3 GDP rise

The Office for National Statistics will release a July number for the index of services on 30 September. This number will be a key input to the preliminary estimate of GDP in the third quarter, to be released on 27 October. The indications are that services output rose solidly in July, in turn suggesting that the preliminary GDP estimate will show respectable quarterly growth – possibly as high as 0.4%. Such an outcome would add to doubts about the necessity of the MPC’s August easing package and could block the further rate cut apparently desired by a majority of Committee members.

There are two reasons for expecting the July services number to be solid. First, retail services output has a 7.1% weight in the index and is measured by retail sales volume, which rose by 1.9% in July, implying a contribution of 0.1 percentage points.

Secondly, services turnover data for July released earlier this week suggest that output increased in a number of other industries.

Translating the turnover data into a forecast for output is not straightforward and attempts here to draw inferences in the past have not always been successful. The difficulties include: turnover is measured in current price terms and is not adjusted for seasonal factors or working days; the turnover survey omits some important output components, including financial services, government activities and imputed rent; and the industry shares in the turnover data differ from the weights used in the output index.

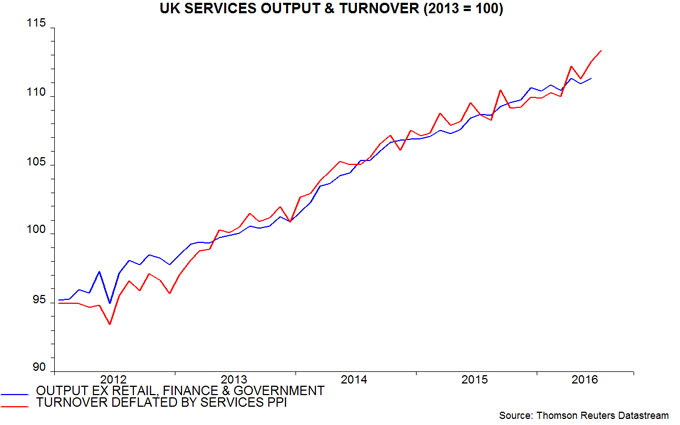

The chart compares a subset of the output index accounting for 58% of the total with an estimated series for real turnover adjusted for seasonals / working days and weighting differences. This series has tracked monthly output changes reasonably well and suggests a further solid increase in July.

Based on the above, total services output may have risen by 0.4% in July, assuming no significant weakness in components for which there is little or no information.

Combined with already-released data on industrial and construction output, such an increase would imply that GDP in July was 0.3% above the second-quarter level. The preliminary third-quarter GDP estimate will also take into account August industrial / construction data (to be released on 7 and 14 October respectively) and early results of the August turnover survey, with statistical methods used to estimate September numbers. These methods are likely to extrapolate recent growth, implying the possibility of a 0.4% quarterly GDP increase barring weakness in the August data.

A 0.4% rise would also be consistent with July / August vacancies data – see previous post.

At its July meeting, the MPC judged that the Brexit vote “was likely to depress economic activity in the near term”. The Committee was more explicit in August, expecting “little growth in GDP during the second half”, with the Bank’s staff forecasting that that the preliminary third-quarter estimate would show no change from the second quarter. Better data forced an upgrade in September but the MPC still anticipated “a material slowing of UK GDP growth”, with the staff estimating a preliminary third-quarter increase of only 0.2%.

Third-quarter growth of 0.4%, with the possibility of a future upward revision, would, therefore, raise question marks about the MPC’s pre- and post-Brexit vote analysis and policy strategy. It could be difficult, in these circumstances, for the Committee to follow through on its strong guidance of a further cut in Bank rate to 0.1% (although Governor Carney’s tendency to find alternative rationales for a desired course of action should not be discounted).

Reader Comments